PRIME Sales Tax Proposal For Federal Budget 2023-24

Libertarianism is a broad political philosophy that upholds Liberty as the core value, seeks to minimise state encroachment on the individual liberties, emphasises rule of law, pluralism, cooperation, civil and political rights, free trade, voluntary association and freedom of expression.

The PRIME Fellowship is a publishing project which is gathering, nurturing and promoting ideas of young writers who are motivated to discover solutions for challenging problems in Pakistan in accordance with the libertarianism philosophy.

As a leading and independent economic think tank PRIME has been advocating for a smaller government, low rate of taxes, and simpler regulations for over 10 years working from Islamabad. As a center of free market ideas and debates, Prime is dedicated to mobilizing younger people towards logical thinking, and empirical study for writing and advocating libertarian solutions.

This PRIME fellowship serves as an umbrella for the entire spectrum of libertarian thinkers residing within Pakistan. Your ideas are welcomed, and your voice is appreciated here. Come and connect with your community.

Apply by completing the Application Form

The Taxpayers Alliance Pakistan (TPAP), initiative of PRIME, an economic think tank, recently organized a meeting of its fellows to discuss ways to improve Pakistan’s taxation system for the upcoming Finance Bill 2023. Attendees included members of the alliance and field experts who aimed to generate proposals that would simplify tax regulations and reduce the compliance burden on taxpayers.

One of the notable contributions at the meeting came from Mr. Anas Farhan, Vice President of ZTBL. He presented a document and a detailed presentation on the advantages of a flat and low-rate taxation system, which was later commented by Mr. Zeeshan Merchant, Former President of Karachi Tax Bar Association (KTBA).

Mr. Farhan’s proposal emphasized the significance of streamlining the tax system and lessening the compliance burden on taxpayers. He argued that a flat and low-rate taxation system would accomplish these objectives while also promoting economic growth and reducing inequality.

The proposal would eliminate the current complex system of tax brackets and exemptions, reducing the need for expensive tax planning and compliance.

Overall, Mr. Farhan’s proposal is a crucial contribution to the ongoing debate on tax reform in Pakistan. It provides a well-argued and clear case for a simpler, fairer, and more efficient tax system that could benefit both taxpayers and the wider economy initiative.

[pdf-embedder url=”https://primeinstitute.org/wp-content/uploads/2023/02/PRIME-Income-Tax-Proposals-23-24.pdf” title=”PRIME Income Tax Proposals 23-24″]

23, Feb 2023

PRIME organized the “Islamabad Policy Exchange”, an in-camera discussion between academic, governance, political, and private sector specialists aimed at sharing and reviewing economic policy reforms and providing feedback to the Government of Pakistan. The discussion revolved around new Urban Policy by the KP government and the IT sector regulations. The participants unanimously agreed that the efficiency in the provision of public service delivery and facilitation of businesses require easing of regulations, digitization of processes and formulation of long-term policies to enable entrepreneurs/ investors to reap the benefits of incentives provided by the government and contribute to economic prosperity.

The KP Urban Policy 2030 is designed with the vision to provide direction and a roadmap for creating inclusive opportunities for individuals, businesses, and communities in urban centers, and facilitate the better use of land, real estate development, provision of municipal services and tourism.

The real estate representatives highlighted the problems faced by them in getting requisite approvals for starting projects as the land records are not completely digitized, lack of clarity on segregation between residential and commercial land, myriad steps of documentation, and a complex bureaucratic system. The digitization of processes and easing of regulations are inevitable for higher economic activity. They also suggested separating Building Control Authority (BCA) and Development Authority (DA) for better urban planning, and easing regulations on the inflow of IT proceeds.

The representatives of the IT services sector, freelancers in particular, highlighted that short-term policies contribute to uncertainty. The restriction of the retention of 35 percent of proceeds is not sufficient and diminishes the incentive to bring 100 percent of proceeds into the country. Resultantly, a significant proportion of the foreign exchange earned is kept outside the country. Moreover, the application of a tax

differently for filers and for non-filers does not encourage the documentation of businesses as they are exposed to higher government scrutiny.

In contrast, the representatives from the government acknowledged the problems arising from short-term policies. However, the documentation of the economy and becoming a part of the taxation system are matters of national interest and obligations of citizens. The participants were informed about the steps taken by the government to facilitate freelancers in terms of opening foreign currency accounts, low tax

rates and ease in the registration of businesses, and more will be announced in the coming budget. The representatives of the government also highlighted that insinuation regarding frequent and undue audits by the FBR is not completely based on reality.

Addressing a seminar titled ‘International Monetary Fund (IMF)-Pakistan deal: impact and the way forward’ on Saturday, Mr Salman said the Washington-based lender should demand concrete structural reforms from the government instead of settling for “creative accounting” gimmicks that only kick the can down the road.

According to Prime Minister Shehbaz Sharif, the IMF has demanded conditions that are “beyond our wildest dreams” for the revival of the stalled $7bn loan programme.

The country needs foreign exchange to continue imports of necessary nature but the IMF has linked the disbursement of dollars to economic reforms that have a high political cost.

He praised Hafeez Shaikh, who took the reins at the Ministry of Finance from Asad Umar in 2019, for putting the economy on a path to stabilisation. But his replacement, Shaukat Tarin, went on a spending spree and wrecked the economy by the start of 2022. Fixing the petrol prices was the beginning of the new phase of this economic crisis, he said.

Unlike most mainstream analysts who swoon over Miftah Ismail, who replaced Mr Tarin as finance minister in April 2022, Mr Salman said his policy of blanket contraction of imports damaged the economy.

“About 90 per cent of our imports are non-luxury,” he said, adding that economic activity came to a halt, reducing the trade deficit in the short run but creating bigger problems in the long run.

Ishaq Dar, the incumbent finance minister, has been an unmitigated disaster for fixing the exchange rate and dillydallying on the IMF loan programme. He accused Mr Dar of indirectly creating a black market of dollars in the country for the first time in 30 years.

Mr Dar’s poor signalling on the restructuring of external loans also put significant pressure on the rupee amidst declining foreign exchange inflows.

A strong proponent of flat taxation, Mr Salman opposed the proposal to increase the general sales tax (GST) rate from 17pc to 18pc to help meet the IMF’s demand for higher revenue.

Instead of imposing more and higher taxes on the already taxed, he suggested that exemptions to businesses costing between Rs1.4 trillion and Rs2tr a year should be done away with immediately. Tax exemptions enjoyed by large agricultural landholders and businesses under the Army Welfare Trust should be withdrawn, he said.

As for state-owned enterprises like Pakistan Steel Mills, he said its land should be handed over to a real estate trust and its employees be paid salaries via its dividends.

Speaking on the occasion, former chairman of the Bank of Punjab Dr Pervez Tahir said the Public Sector Development Programme (PSDP), under which the federal government carries out development projects, should be put on hold for one year. The freeze should apply to the already-underway development projects as well in order to help the government put its fiscal house in order.

Taking part in the discussion, Sustainable Development Policy Institute economist Dr Sajid Amin said political parties should avoid playing politics on the IMF programme.

The country is likely to witness an economic growth rate of 1-1.5pc in this fiscal year even though some independent economists have predicted negative growth, he said.

Policymakers should prepare for a debt re-profiling exercise as soon as the IMF programme is revived, he added.

ISLAMABAD-PRIME, an independent economic think tank, has noted that out of control spending and excessive government footprint have put public sector on the brink of collapse.

PRIME has published a quarterly report, Prime Plus, on Pakistan’s economy comprising an analysis of the progress and developments on the pillars of economic prosperity in CY 2022. The report also contains an analysis of the trends in macroeconomic indicators in the second quarter of FY 2023. The report highlights that Pakistan is facing challenges on the domestic and external fronts, and absence of reforms to address the structural issues has weakened the prospects of economic recovery.

Economic prosperity is contingent upon identifying and resolving problems prevalent in the economy, which otherwise hinder economic activity and efficiency. Dr. Arthur B. Laffer, while analyzing the underlying reasons for recurring crises in Pakistan, highlighted six pillars of economic prosperity. The pillars are deregulate the economy, cut spending, rationalize taxes, reduce trade barriers, establish sound money and privatize loss-making state-owned enterprises. The report highlights that the footprint of the government in the economy is increasing as shown by a continuous increase in the annual recurring expenditures. The current expenditures increased by 15 percent from Rs. 7.5 trillion in FY 2022 to Rs. 8.6 trillion in FY 2023. The grants and transfers increased from Rs. 1 trillion in FY 2022 to Rs. 1.2 trillion in FY 2023. The unfunded subsidies like the provision of cheap electricity to the export sector and agriculture package contribute to fiscal imbalances and deficits.

The taxation system in Pakistan is complex and remains incapable of completely financing public expenditures. The revenue generation has remained skewed towards indirect taxes with a 63 percent share while direct taxes contribute only 37 percent. One of the reasons behind lagging performance is the prevalence of exemptions. In FY 2022, the tax expenditure was Rs. 1.4 trillion or 2.6 percent of GDP. Moreover, large number of taxes and high rates have reduced the compliance of people due to which the government has to extend deadline for filing returns several times every year.

The report indicates that CY 2022 was a spectacle of trade suppression. The government restricted the imports through a complete ban on imports of some goods, requirement of a 100 percent cash margin, blocking of LCs and reducing the limit of international transactions. Moreover, the SBP also jacked up the rates of export financing scheme and long-term financing facility to slowdown industrial activity and imports.

The currency market remained highly volatile in CY 2022 where the rupee lost its value by 28 percent from Rs. 177 in January to Rs. 227 in December. However, it is widely believed that exchange rate was being managed by the government. This management contributed to emergence of three exchange rates in the country; interbank rate, open market rate at which dollar is not available and black market rate at which dollar is being traded.

The governments have been lagging in cutting losses through privatization of loss-making SOEs. The total losses of SOEs in 2019 were Rs. 143 billion and accumulation of debt till May 2022 was Rs. 1.74 trillion. Every year government includes revenues from privatization in budget but did not proceed due to political considerations. The unsatisfactory performance of the government in all the themes has contributed to exacerbation of the crisis. Moreover, the delay in the completion of 9th review of the IMF program can also be attributed to these factors.

The report highlights that political instability in the country has contributed to the deterioration in business conducive environment. The delay in the resumption of the IMF program, trade restrictions, depletion of foreign exchange reserves and currency devaluation are responsible for slowdown in economic activity. The trade restrictions and exchange rate management has not only reduced the current account deficit but led to a fall in exports, remittances and reemergence of informal banking channel for international transactions.

The government is struggling to control inflation and people continue to face a rise in prices and a fall in purchasing powers. The underlying reasons for inflation are not only an increase in international petroleum and food prices but also an increase in money supply at home and a delayed response of the SBP to raise policy rate. Moreover, the restriction on imports also contributed to disruption in the supply of goods and subsequently, the increase in prices due to shortages. There are following steps that the government needs to take to mitigate the crisis. The government needs to reduce its footprint in the economy to create space for the private sector to become an engine of growth.

The government needs to cut its expenditures to improve fiscal management and move away from domestic borrowing to ensure availability of capital for the private sector. Taxation system in the country needs to be overhauled by reducing the number and rates of taxes to broaden the tax base and promote compliance. Import substitution policy has failed to reap desired objectives. The government needs to open trade by reducing tariff and nontariff barriers to allow transfer of knowledge and technology and incentivize innovation for the domestic industry through exposure to international competition. The government needs to control the monetary expansion by reducing borrowing for public expenditures to control inflation. Market determined exchange rate is the key to stability in the currency market and stopping depletion of foreign exchange reserves. Loss-making SOEs need to be privatized on a priority basis to reduce the burden on the government and pace of debt accumulation.

External debt servicing burden country faces today is one of the highest in the world

Ali Salman | January 09, 2023

It clarified that “this will…come at the expense of meeting additional conditionalities agreed with the creditors, who will bear the cost of restructuring. None of these options are without economic pain, but a well-managed restructuring process can allow the economy to recover faster than otherwise.”

In this article, I will advocate this view that given the trade-off, the Ministry of Finance should seriously consider debt restructuring.

To provide a context, Pakistan’s external debt servicing has increased from $6.5 billion in FY13 to close to $26 billion in FY23. This is equivalent to 65% of Pakistan’s exports (estimated at $40 billion in FY23) and 37% of exports and remittances.

In 2013, Pakistan’s external debt servicing was only 20% of exports. The external debt servicing burden (as a percentage of exports and remittances) that Pakistan faces today is one of the highest in the world.

The finance minister has repeatedly maintained that Pakistan will not consider debt restructuring and will honour its external debt servicing. So far, he has managed to deliver on his promises.

It seems that he is pursuing a two-pronged strategy: one is reliance on friendly countries like China and Saudi Arabia. Last week’s army chief visit to Saudi Arabia and a telephonic contact between the premiers of China and Pakistan must be related to the same strategy.

The second part of his strategy seems to secure additional funding from external sources, especially the Geneva conference, for flood rehabilitation.

Pakistan is seeking $16 billion of grants and debt under this head, from which it has received about $4 billion already. This may be sufficient to secure external debt servicing for FY23 without the need of any restructuring.

Although the international agencies are demanding strict control over the planned spending, money, in the end, is fungible.

However, if Pakistan’s hopes of securing significant additional external funding for flood rehabilitation are not fulfilled, then the reliance on expectations from friendly countries will become critical.

Also, pressure to increase electricity tariff and fuel surcharge will be difficult to resist, which will be detrimental to the cost of living and the dwindling political capital of PML-N.

Alternatively, we propose that Pakistan should sit down with all creditors to agree on a new schedule of external debt servicing and at the same time lift administrative controls on import and import payments immediately.

Once we do it, business activities will restore and economic output will begin to gain momentum. While trade deficit may increase as a result, this should not worry us.

About 90% of Pakistan’s imports are non-luxury in nature. It means that it is very costly to control imports without the risk of an overall economic slowdown. We have already witnessed it in the last quarter of 2022.

Any calls for import substitution at the policy level should be strictly discouraged, while markets may be encouraged to become more competitive.

Importantly, this strategy will minimise the gap between the open market and black market exchange rate. Once this is done, the remittance flow through banking channels will not decrease and exporters will be encouraged to realise their receivables sooner than later.

This will bring a substantial increase in the monthly dollar inflow, which will provide an additional cushion to Pakistan’s forex reserves, thus giving some degree of confidence to the policymakers, and to the market.

Debt restructuring will also decrease the pressure on the government to increase electricity tariffs or petroleum levy, though in the end, we will need to respect international prices.

There will be genuine apprehensions of a further downgrade by the international credit rating agencies in the case of debt restructuring. This concern is not well-placed.

First, Pakistan’s bond has already been downgraded to the junk status despite timely payments on Eurobonds in December 2022. This was in the making since the middle of 2022, owing to the catastrophic fiscal decisions made by the ousted PTI government.

In this context, the finance ministry under Miftah-Dar deserves credit for reducing the risk of default at least in the recent past.

That does not preclude the risk of a disorderly default in the future. The fact that banks are dishonouring LCs of importers is a default at least at the private-sector level.

The banks are claiming difficulty in release of dollars due to administrative controls by the central bank. Dar has made it public that while he is not going to change the SBP autonomy status, he believes that this has gone too far.

Ultimately, credibility, predictability and transparency in economic decision-making is the most important strategy for any government. This should be rules-based and not based on discretion.

Economic stability can be ensured by sticking to these rules and by institutionalising economic governance.

As the EAG press release reminds us, policymakers must acknowledge the difficult choices the country faces and overcome policy paralysis to avoid the dire consequences of a disorderly default.

The writer is the executive director of PRIME, an independent economic think tank based in Islamabad

This article was originally published in The Express Tribune on January 9th, 2023.

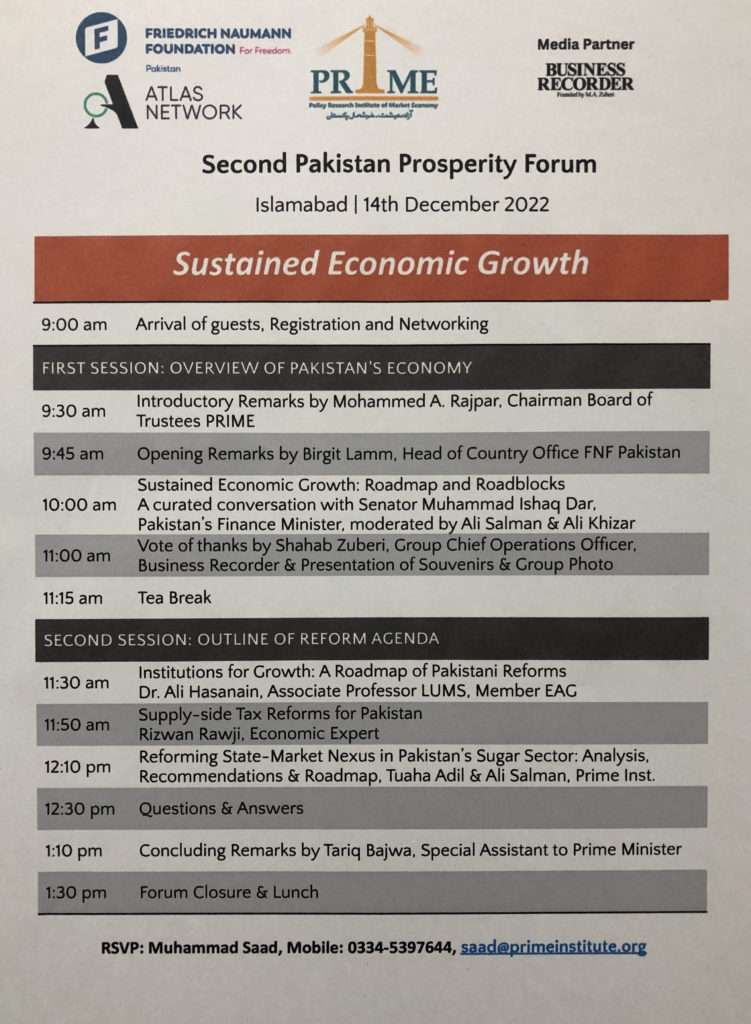

Prime Institute organized “Second Pakistan Prosperity Forum” on 14th December 2022 at Islamabad. Finance Minister, Muhammad Ishaq Dar, took part in the forum’s curated conversation, moderated by Ali Salman and Ali Khizar. Other speakers included Dr. Ali Hasanain, Rizwan Rawji and Tuaha Adil. The main purpose of the Forum was to further the debate on ideas and policies needed to put Pakistan on a path to prosperity, which will lead to better living standards for a vast majority of Pakistani’s.

Second Pakistan Prosperity Forum 2022

Marriott Hotel, Islamabad, 14th December 2022

AGENDA

PRESS RELEASE

In 2020, the Government of Pakistan conducted an inquiry into the sugar industry. The inquiry committee found irregularities in the sugar mills and claimed the prevalence of cartelization by sugar mills. Later the government constituted a committee to suggest recommendations for the overhaul of the sector and promote price stability. The committee also acknowledged the prevalence of excessive regulations and their contribution to the distortions and recommended removal of the excessive administrative footprint.

[CONTINUED]

To read more, click here: PRIME Policy Report – Project Sugar

For media inquiries, contact saad@primeinstitute.or

PRIME organized a consultative roundtable on 20th October 2022 to facilitate a discourse on the sugar sector and solicit views on the draft report from various stakeholders. The event was attended by government dignitaries, members of the Pakistan Sugar Mills Association, farmers, agriculture specialists and economists. There were 7 speakers and 30 individuals from different institutions participated.

[CONTINUED]

To read more, click here: Minutes of consultative roundtable.

For media inquiries, contact saad@primeinstitute.org