Illegal trade: short-term gains, long-term economic decline

Instead of asking IMF for $6b, govt must aim to plug tax loss hole of Rs1.5-2tr

Author: Dr Ali Salman

“Record high inflation is perhaps the most pressing problem,” said TRACIT Director-General Jeff Hardy. “When prices rise faster than incomes, illicit and black-market products become more tempting to consumers desperately cheaper alternatives.”

Speaking on this occasion, Executive Director of PRIME, Dr Ali Salman explained that “the 68 Billion Dollar black and gray markets are fueled by high taxes, tariffs and duties, because in these times of crippling inflation, citizens have nowhere else to go”.

According to Dr Salman, “Unless we minimize barriers to legal trade, the government of Pakistan has no chance of generating enough growth to raise required tax revenues and is set on a clear path towards bankruptcy”.

In Pakistan, the shadow economy is already equal to about 40 percent of GDP and significant levels of illicit trade can be found in many key economic sectors, including food fraud, illicit petroleum pesticides, counterfeiting, and trade in falsified and substandard pharmaceuticals. Discussants at the forum delineated the challenges faced in tackling illicit trade across sectors.

“These illicit markets have plagued the country for years – perpetuating a vicious circle of associated money laundering, organized crime, corruption, and tax evasion,” said Mr. Hardy. “We are pleased that the government is stepping up law enforcement against smuggling, money laundering and black marketers.”

Tax evasion is also a major problem in Pakistan, undermining its capacity for fiscal resource mobilization, especially when it amounts to as much as 6 percent of GDP. Tax evasion related to illicit trade in tea, tires and auto lubricants, and pharmaceuticals has grown to about PKR160 billion per year. The unregulated, untaxed illicit trade in cigarettes, which had increased about 10 percent over the last few years, now drains PKR 240 billion from fiscal revenue collections.

“Improving enforcement and tax collections can help mobilize domestic revenues without the need to raise taxes, which could stifle growth and the fragile economic recovery,” said Mr. Hardy. “Additional revenues resulting from tighter compliance with existing taxes and track and trace systems can help preserve economic stability and enhance debt sustainability.”

TRACIT and the Prime Institute also signed a Memorandum of Understanding establishing a framework for cooperation to mitigate illicit trade in Pakistan. Among the agreed areas for collaboration will be the development of a new, in-depth investigation of the size, scope and associated negative impacts of illicit trade on the Pakistan economy.

“One of the main takeaways from today’s meeting is the urgent need for more information and a better understanding of the drivers of illicit trade in Pakistan,” said Dr Ali Salman, Executive Director of the Prime Institute.

“We look forward to working with the Pakistan government and will leverage on the international expertise of TRACIT to start a research and advocacy agenda to implement comprehensive policies that consider the potential impact on all sectors of the economy and work to reduce the incentives for criminals to engage in illegal activities.”

Dr Ali Salman highlighted that “Smuggling is growing faster than legal trade and presently stands at 20% of GDP, indicating that formal markets are unable to meet the increasing demand of the Pakistani middle class. who are willing to take high risks to avoid the excessive cost of taxes and tariffs.

About TRACIT: The Transnational Alliance to Combat Illicit Trade (TRACIT) is an independent, private sector initiative to mitigate the economic and social damages of illicit trade by strengthening government enforcement mechanisms and mobilizing businesses across industry sectors most impacted by illicit trade.

About PRIME: The Policy Research Institute of Market Economy (PRIME) is an independent economic policy think tank based in Islamabad.

Contact: Cindy Braddon, Head of Communications and Public Policy, TRACIT, Tel: +1 571-365-6885 / cindy.braddon@TRACIT.org / X: @TRACIT_org. The full report and associated content are available at www.TRACIT.org.

The government provided financial support of Rs. 1.93 trillion to SOEs during FY 2019-22 to keep them operational. The power sector posted a loss of Rs. 321 billion, while the infrastructure, transport, and communication sector posted a loss of Rs. 295 billion.

PRIME has published its quarterly assessment report, Prime Plus April 2024, which analyzes the financial performance of State-Owned Enterprises (SOEs) in Pakistan. The report evaluated the financial performance of SOEs and the private firms operating in the oil and gas marketing sector, banking sector, steel sector, and power generation sector.

The Power Sector and Infrastructure, Transport and Communication (ITC) Sector were the major contributors to the overall loss, incurring losses of Rs. 321 billion and Rs. 295 billion, respectively, during the fiscal year 2022. On the loss-making side, seven out of the ten largest loss-making SOEs are DISCOs, while the remaining three entities belong to the ITC sector. The combined losses of DISCOs amounted to Rs. 375.81 billion in FY 2022 alone. Pakistan Steel Mills incurred a loss of Rs. 206 billion from 2019 to 2022. In contrast, the Oil and Gas sector, a highly regulated sector, stands out as the most profitable segment within the SOE portfolio.

The report highlights vulnerability to external shocks emanating from wars. The continuity of the Russia-Ukraine war and unbated Gaza genocide may promote uncertainty throughout the world. These wars have affected trade in the Mediterranean Sea, which could result in disrupting the supply chain. Externally, the financial obligations due to debt and imports will keep the exchange rate under stress as the foreign exchange reserves are merely sufficient for two months’ imports. It is pertinent to highlight that a market-based exchange rate is the only way to promote economic sustainability.

Domestically, public finance is under pressure due to higher expenditures and lower revenue collection. FBR collected Rs. 2,241 billion in the third quarter of FY 2024. During the first nine months of FY 2024 (July-March), FBR collected Rs. 6.710 trillion, beating the Rs. 6.707 trillion target by Rs. 3 billion. Compared to revenues, the total government expenditure increased by 49 percent to Rs. 7,532 billion against Rs. 5,058 billion in the first seven months of FY 2023.

In the third quarter of FY 2024, total government borrowing increased by Rs. 2,490 billion compared to an increase of Rs. 1,959 billion last year. At the end of the third quarter of FY 2024, total government borrowing was cloaked at Rs. 28.2 trillion. The government borrowing from the scheduled banks increased by Rs. 1,405 billion in the third quarter of FY 2024. The central government’s total debt stood at Rs. 64.8 trillion, out of which domestic debt is Rs. 42.7 trillion and external debt is Rs. 22.1 trillion.

Inflation remains a challenge for the government. People face continuous declines in their purchasing power. In the third quarter of FY 2024, the average CPI inflation stood at 24 percent compared to 31.5 percent in FY 2023. The inflation in the first nine months of FY 2024 stood at 27.06 percent. The underlying cause of inflation is the higher growth in the money supply compared to the growth in the supply of goods.

The government needs to ensure efficient allocation of resources and reevaluate its spending patterns. The government cannot continue to support loss-making SOEs and should prioritize the privatization of the highest loss-making enterprises. An increase in revenue generation has been observed, but the government should refrain from increasing tax rates and focus on broadening the tax base. This could be accomplished through a flat, low-rate, and broad-based taxation system.

The report is available on PRIME’s website and can be accessed by clicking here

For further information, contact our communications officer Mr. Farhan Zahid at farhan@primeinstitute.org or call +92 331 522 6825.

Pakistan’s economy is struggling with low growth due to a lack of necessary prerequisites for economic prosperity. The path towards prosperity is determined by the functioning of markets, which requires economic freedom for its agents.

Economic freedom is defined as the degree to which individuals’ property rights are respected in society. Money is a property held by almost all individuals, as market transactions now take place in exchange for money.

To ensure property rights over money, macroeconomic policies must maintain its soundness. In the modern world, a country’s money is sound if its value remains stable against domestic and foreign goods, services, real and other financial assets.

The Fraser Institute of Canada uses the Economic Freedom Index to evaluate and rank countries based on their economic freedom. The index consists of five categories, including sound money.

According to the latest annual report, Pakistan ranks 123rd out of 165 countries with a score of 5.98/10. Unfortunately, Pakistan’s rank for sound money is even worse, standing at 150th out of 165 countries with a score of 6.37/10.

Pakistan has maintained an average score of 6.22 for sound money from 2001 to 2023, with the highest score of 6.83 observed in 2002 and the lowest score of 4.60 in 2023.

From 1974 to 2023, the purchasing power of money for the goods and services included in the Consumer Price Index (CPI) basket decreased by a factor of 68. Similarly, the value of one US dollar went up from less than Rs10 in 1974 to Rs248 in 2023, leading to a 25-fold loss in the rupee value.

This monetary fragility can be attributed to excessive monetary growth, where broad money (M2) has grown significantly faster than the real and nominal gross domestic product (GDP).

Over the past 50 years, the real GDP increased by 10 times and the nominal GDP increased by 644 times, while money supply expanded by over 1,000 times.

The report reveals that the government is mainly responsible for the unsoundness of money due to the inefficient mix of monetary, fiscal, and exchange rate policies. Specifically, the rate of monetary expansion has been out of sync with economic fundamentals.

Pakistani government has historically relied heavily on borrowing from the SBP to finance its budget, leading to an unsustainable monetary expansion. Although the amended SBP Act has limited the government’s ability to issue debt to the central bank, monetary expansion has continued.

The SBP has attempted to control inflation and currency depreciation through a reactionary approach, using interest rate as its policy instrument. However, this approach has been unsuccessful, as keeping market interest rates close to the SBP policy rate makes it difficult to control money supply.

If the government, the lead borrower in the market, does not reduce its demand for funds in response to interest rate hikes, achieving the interest rate target becomes challenging. The SBP has to provide necessary liquidity to the market to achieve short-term interest rate targets, making it impossible to control monetary expansion.

The government’s fiscal branch is often held responsible for monetary expansion, resulting from increased spending without the matching revenue. While this argument holds, the federal government is currently caught in a cycle of debt accumulation.

The seventh NFC Award increased the share of provinces compared to the federation, which may be desirable but has made the federal government vulnerable to shocks. The delay in implementing reforms to reduce the size of the federal government in accordance with the 18th Constitutional Amendment exacerbated the problem.

After paying the provinces their due share, the federal government is left with limited resources that are hardly sufficient to service its debt. Debt servicing being charged expenditure is paid first, leaving the government with no room to provide public goods.

Moreover, the government has to borrow more to service its debt when the SBP raises interest rates to control inflation. This borrowing strains the market for loanable funds, prompting the SBP to inject liquidity. Hence, the money supply expands despite the government being barred from directly borrowing from the SBP.

A comprehensive reform agenda is required to improve Pakistan’s money stability. This includes reducing the size of the government, coordinating fiscal and monetary policies more effectively, managing debt efficiently, and creating an environment that promotes sustained and inclusive economic growth.

Reviewing the current monetary-fiscal policy mix and determining an appropriate operating instrument for the State Bank to limit monetary expansion and maintain its autonomy is crucial.

The practice of expanding money supply in response to government borrowing from scheduled banks while setting the policy rate to contain inflation is not productive.

The government has to comply with the Fiscal Responsibility and Debt Limitation Act, and an accountability mechanism should be in place for non-compliance..

The Policy Research Institute of Market Economy (PRIME), in collaboration with the Atlas Network, hosted a report launch event for the ‘Pakistan Economic Freedom Audit: Sound Money as a Case Study.‘ on 29th, March 2024.

The event featured speakers including Dr. Ali Salman, Executive Director of PRIME, Dr. Wasim Shahid, the report author, and Dr. Nadia Tahir, Economist. The audience included a diverse group of professionals from academia, government, media, and field experts.

To read the full report “Pakistan Economic Freedom Audit: Sound Money as a Case Study,” click below:

Click below for more details:

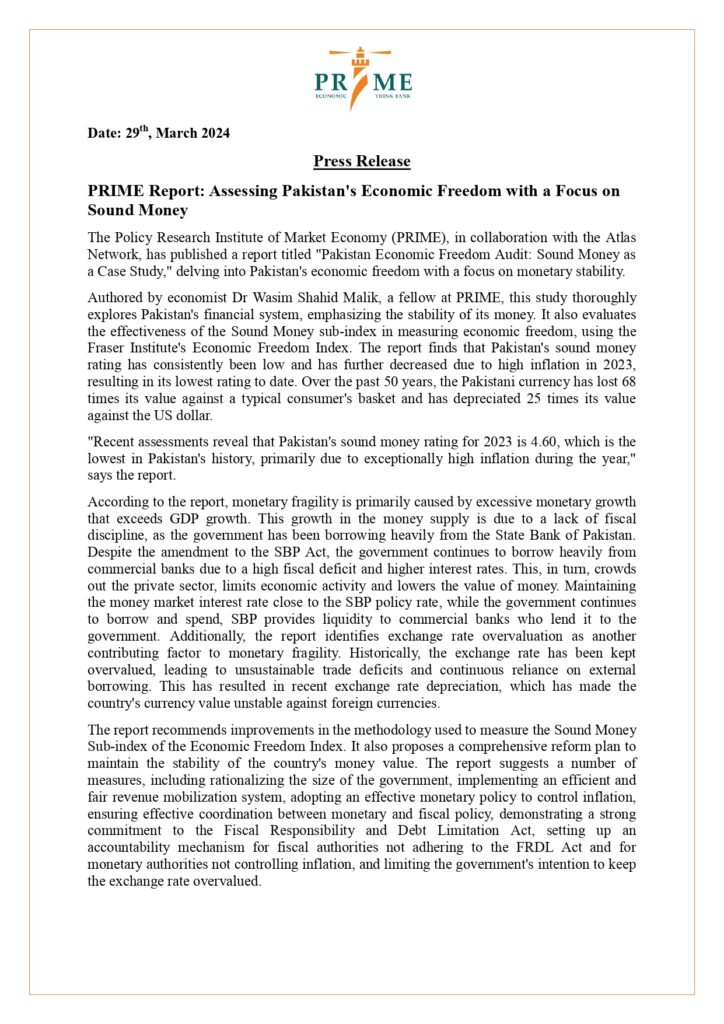

The Policy Research Institute of Market Economy (PRIME), in collaboration with the Atlas Network, has published a report titled “Pakistan Economic Freedom Audit: Sound Money as a Case Study,” delving into Pakistan’s economic freedom with a focus on monetary stability.

Authored by economist Dr Wasim Shahid Malik, a fellow at PRIME, this study thoroughly explores Pakistan’s financial system, emphasizing the stability of its money. It also evaluates the effectiveness of the Sound Money sub-index in measuring economic freedom, using the Fraser Institute’s Economic Freedom Index. The report finds that Pakistan’s sound money rating has consistently been low and has further decreased due to high inflation in 2023, resulting in its lowest rating to date. Over the past 50 years, the Pakistani currency has lost 68 times its value against a typical consumer’s basket and has depreciated 25 times its value against the US dollar.

“Recent assessments reveal that Pakistan’s sound money rating for 2023 is 4.60, which is the lowest in Pakistan’s history, primarily due to exceptionally high inflation during the year,” says the report.

According to the report, monetary fragility is primarily caused by excessive monetary growth that exceeds GDP growth. This growth in the money supply is due to a lack of fiscal discipline, as the government has been borrowing heavily from the State Bank of Pakistan. Despite the amendment to the SBP Act, the government continues to borrow heavily from commercial banks due to a high fiscal deficit and higher interest rates. This, in turn, crowds out the private sector, limits economic activity and lowers the value of money. Maintaining the money market interest rate close to the SBP policy rate, while the government continues to borrow and spend, SBP provides liquidity to commercial banks who lend it to the government. Additionally, the report identifies exchange rate overvaluation as another contributing factor to monetary fragility. Historically, the exchange rate has been kept overvalued, leading to unsustainable trade deficits and continuous reliance on external borrowing. This has resulted in recent exchange rate depreciation, which has made the country’s currency value unstable against foreign currencies.

The report recommends improvements in the methodology used to measure the Sound Money Sub-index of the Economic Freedom Index. It also proposes a comprehensive reform plan to maintain the stability of the country’s money value. The report suggests a number of measures, including rationalizing the size of the government, implementing an efficient and fair revenue mobilization system, adopting an effective monetary policy to control inflation, ensuring effective coordination between monetary and fiscal policy, demonstrating a strong commitment to the Fiscal Responsibility and Debt Limitation Act, setting up an accountability mechanism for fiscal authorities not adhering to the FRDL Act and for monetary authorities not controlling inflation, and limiting the government’s intention to keep the exchange rate overvalued.

The report is available on PRIME’s website and can be accessed by clicking here

For further information, contact our communications officer Mr. Farhan Zahid at farhan@primeinstitute.org or call +92 331 522 6825.