Election 2024 And Tax Reforms

Election 2024 And Tax Reforms

Dr. Ikramul Haq | 21, December, 2023

Now that the Supreme Court of Pakistan has made it clear that no case will be entertained that disturbs the schedule announced by the Election Commission of Pakistan (ECP) for general elections, to be held on February 8, 2024, it is the time that all the political parties unveil their election manifestos. It is high time that agenda for tax reforms should be made the central theme of election manifestos by all contesting parties. Pakistan cannot come out of the prevailing economic crisis, the worst in its 76-year-old history, unless long-delayed and much-needed fundamental structural reforms are made. These alone can ensure self-reliance for the country bringing relief for all citizens and bringing the nation back on the road to prosperity.

Since the adoption Constitution (Eighteenth Amendment) Act, 2010, [commonly called “18th Amendment”], became effective on April 19, 2010 after receiving the assent of President of Pakistan, fiscal management, both at federal and provincial levels, has been posing serious challenges for the country.

In this article an attempt is made for establishing a fair and just tax system. Taxes should be collected justly and spending must be prudent ensuring delivery of social services, equal opportunities and economic justice to all citizens. Reform in one sector ignoring the ills in the other, resorting to improving something at the cost of leaving aside the one interlinked, will not yield desired results. The case of tax reform divorced from elimination of black economy is the point in focus. The main cause of fiscal deficit is allowing an unprecedented size of underground economy to flourish and the perpetual existence of incompetent and inefficient tax machinery as well as borrowing for non-productive projects to receive hefty kick backs.

The inquiry ordered in 2018 on this issue, soon after coming into power on August 19, 2018 by the ex-premier, now serving a jail term, was never completed whereas under the existing bilateral and multilateral tax treaties, this kind of information could have been very easily obtained. In fact information did come, but the Government of Pakistan Tehreek-e-Insaf (PTI) and National Assembly gave unprecedented assets-whitening amnesty, see details in Unconstitutional asset-whitening schemes & amnesties.

The lesson from above is clear that reforms in tax administration without routing the causes of parallel economy and vice versa is not going to improve our fiscal woes. The failure of democracy in Pakistan, among many other factors, is attributable to lack of democratic values within political parties—they do not file their own tax returns. It is highlighted in Civil governments, ‘Ordinance’ factories as under:

“Exemplary punishment should be awarded to all holding public office, members of services, or holding any constitutional position, as custodians of public trust, if they commit corruption or are found guilty of wrong declarations of their assets/liabilities or avoid paying any dues (taxes and/or others).

The main job of the legislators is to pass laws to protect public rights, ensure welfare for all, especially the less-privileged and provide effective justice system safeguarding that rule of law and transparency are key to counter private interests over public interests. On the contrary, since 2008, all successive governments have shown formidable resistance against establishment of an independent anti-crime authority, as National Crime Agency of United Kingdom. We follow its model of democracy but when matter comes to accountability, defy it with impunity. All in power and in opposition know that such a body would expose their corruption and other malpractices—especially the command of the Constitution under Article 17(3) saying: Every political party shall account for the source of its funds in accordance with law.

It is shocking that only two political parties filed income tax returns for tax year 2020 out of 27 registered with FBR and 127 with Election Commission of Pakistan despite section 114(1)(ac) of the Income Tax Ordinance, 2001 that makes it mandatory. How can we expect rule of law in Pakistan, when 125 political parties are committing flagrant violation of Article 5(2) of the Constitution? They keep on bashing FBR but fail to fulfill the commands of the Constitution.

The civil society and media should join hands to force the Parliament to abolish all laws of secrecy and/or immunity and enact a law in terms of Article 19A of the Constitution for compulsory disclosure of assets/liabilities/taxes paid by judges/generals/high-raking civil officers. In 2020, members of Women’s Action Forum (WAF) sought under the Right of Information Act, 2017, information regarding assets, salaries and perks of honourable judges of Supreme Court and High Courts as well as of military leadership. However, none responded, except Justice Qazi Faez Isa, who provided the details of him and his spouse and all family members”.

It is, thus clear that unless the parties reform themselves by introducing fundamental changes in their working, there is dim hope for meaningful (sustainable) democracy in Pakistan. In all established democracies, political parties regularly hold elections, publish their audited accounts, file tax returns, disclose details of expenses and names of donors—all these elements are conspicuous by their absence in our political culture. Media must start a campaign asking political parties to meet these standards.

The agenda/roadmap for reforms to achieve accelerated and sustained growth was launched on April 22, 2021 by Pakistan Institute of Development Economic (PIDE) in ‘PIDE Reform Agenda for Accelerated and Sustained Growth, It must be seriously considered by the policymakers and legislators. In Part 10 of this study, reforms and actions for fiscal consolidation have been discussed succinctly.

As suggested in the study of PIDE, Pakistan has to move towards higher growth for which comprehensive tax reforms are inevitable. We must strive for 7% sustainable growth for at least a decade for achieving desired tax-to-GDP ratio of 20-25%. This is not possible unless we have a paradigm shift in tax policy and revamping of national tax administration for generating sufficient resources for the federal and provincial governments with drastic cuts in wasteful and unproductive expenses and bring innovation and efficiency in public and private sectors. It must be the top priority in national budget 2024-25 after general elections to reduce rate of all taxes and broadening the base.

The enactment of new income tax law, taxing all sources, including agriculture, and harmonised sales tax (HST) on goods and services and establishment of single national tax agency [National Tax Agency (NTA)] are essential. This is possible under Article 144 of the Constitution of Islamic Republic of Pakistan [“the Constitution”]. While the collection will be through NTA, distribution is going to be strictly under Article 160 of the Constitution. The fully automated NTA, operated by professionals under All Pakistan Unified Tax Services, will be supervised by an independent Board of Directors. The status of the NTA should be as provided in Federal Board of Revenue Act, 2007 that after merger will be renamed as Pakistan Revenue Board (PRB).

The crux of two studies [Towards Flat, Low-rate, Broad and Predictable Taxes (PRIME Institute, Islamabad, 2020] and Tax Reforms in Pakistan: Historic & Critical View [Pakistan Institute of Development (PIDE) 2020] is: lower, predictable and broad-based taxes, administered through efficient tax apparatus enabling Pakistan to achieve fairness in taxation system. It will create incentives for better compliance and lead to accelerated economic growth. A paradigm shift is required to restructure the entire tax system to induce more investment, accelerate growth and ensure economic prosperity for the country benefitting all members of society.

These studies analyse the structural and operational weaknesses of the existing tax system at federal level and suggest alternate solutions in the following areas that require fundamental reforms:

Area Solution

Complex Income

Taxation: Low-rate Income

Taxation

Distorted/Multiple

Sales Taxes Single-stage,

single-digit Sales Tax

Customs/SRO Culture Single-rate Customs Duty Multiple Tax Collection Agencies National Tax Agency

Inefficient Appellate System Federal Tax Tribunal

The PRB, unlike FBR, should not have any role in framing tax policy. For this a permanent Tax Policy Board should be established in the light of Article 156(2) of the Constitution with Planning Commission to become a permanent secretariat for federalised economic development. The role of Policy Board in this permanent secretariat should be of a think-tank to recommend policies for equitable and accelerated growth on national level as well as helping all assemblies and Senate for legislation to achieve the desired goals. For example, 2% cess exclusively for debt retirement, imposed on the ultra-rich.

Through democratic process, all the provincial parliaments may pass resolutions under Article 144 of the Constitution, giving powers to the National Assembly and Senate to enact laws for harmonising sales tax on goods and services and income tax from all sources to be collected through PRB. It would facilitate people to deal with a single body, one-window facility at national and provincial levels.

The mode and working of PRB can be discussed and finalised under Council of Common Interest [Article 153] and its control can be placed under National Economic Council [Article 156]. Tax collection and compliance at national level cannot be improved without establishing NRB and introducing an integrated Tax Intelligence System (ITTS) that can correlate imports, exports, sales tax collection on goods and services with income tax returns and monitor all transactions. A fully automated, professional and efficient PRB would alone be in a position to improve capacity by detecting tax avoidance and evasion through ITTS.

India, after long consultations and deliberations enacted the Central Goods and Services Tax Act, 2017 (CGST Act). The CGST Act, through harmonising indirect tax on goods and services, has broadened the tax base. Voluntary compliance, due to a robust IT infrastructure, has increased registration by almost 90% (23 million active CGST Act registrations, as on March 31, 2022). Collection showed substantial growth, from INR 7.7 trillion in FY 2018 to INR 11.7 trillion in FY 2019 to 18.2 trillion in FY 2022. Due to the seamless transfer of input tax credit from one state to another in the chain of value addition, there is an in-built mechanism in the design of CGST Act that incentivizes tax compliance by businesses.

It is thus imperative that the new elected federal government with the consultation and consent of all provincial governments introduce Harmonised Sales Tax (HST) on goods and services in Pakistan that will foster a vibrant market and contribute significantly to the growth of economy. Pakistan needs to move fast towards harmonising taxes and collection through PRB. In India, this is under Goods and Service Tax Council. It will not only reduce the cost of collection of taxes but help in creating a centralised data bank for efficient collection of taxes and counter avoidance and evasion.

Before establishing PRB as an efficient and integrated tax administration, major information technology and human resource improvements in tax collection methods as well as effective audit techniques should be developed along with development-oriented tax policy. Tax reforms are meaningless without an effective tax administration and rational tax policy that can ultimately provide funds for social services to all citizens at grass root level as envisaged under Article 140A of the Constitution.

As a long-term reform measure, we must concentrate on devolution of political, administrative, financial responsibility and authority to the elected representatives of the local governments, after training candidates (preferably fresh graduates) with millions near home getting jobs for secretarial support, achieving the much-desired target for employment.

Tax reforms undertaken to date, have mainly been patchwork, and proven to be an exercise in futility. Tax reform commissions and consultative committees, constituted for reforming the system, have proven to be unsuccessful as they have been suggesting remedies for curing the incurable or otherwise curing symptoms rather than addressing the causes.

The reforms, including World Bank-funded six-year-long Tax Administration Reforms Project (TARP), have failed to encourage people towards voluntary tax compliance. The number of tax filers has fallen since 2003 (excluding those filing income below taxable limit of paying negligible amount to become part of Active Taxpayers List to avoid higher incidence of withholding taxes).

In 2020, the Federal Government obtained loan of US$400 million for Pakistan Raises Revenue (PRR) Project. It may be mentioned that the total cost of Pakistan Raises Revenue (PRR) Project is estimated at US $1.6 billion, of which counterpart contribution is $1.2 billion and IDA financing is US$400 million. Following in the footsteps of the Federal Government, the Punjab Government also decided to borrow US$304 million from the World Bank for tax reforms and it was approved by Planning Commission on September 16, 2020. Like earlier programmes, these are also bound to fail as the consultants of lenders/donors have not idea of our constitutional framework and mundane realities.

The only viable option for meaningful change is to replace the existing tax system with lower, flat and a predictable tax system that is simple, pragmatic, growth-oriented, and broad-based. With such a system in place, those who are not into the tax net or who avoid true disclosures would be induced to pay their taxes voluntarily. This should be coupled with transparent and quality spending of taxpayers’ money for welfare of society as a whole and incentivizing growth and economic well-being of every individual.

The study, Towards Flat, Low-rate, Broad and Predictable Taxes, suggests not only we have s single tax agency, the same should also administer various social and economic benefits and incentive programmes, otherwise tax compliance will remain a distant dream. People must get free education, quality healthcare, decent housing/transport plus social security schemes, such as, disability allowance, old age benefits, income support, child support, pension, just to mention a few, in lieu of paying fair taxes.

The existing four-tier tax appellate system has also failed to deliver. The problems faced by taxpayers in appeals/references speak volumes of the ineffectiveness of various judicial forums that have been assigned the statutory obligations to safeguard them against unjust imposition of taxes. The revenue authorities are also unhappy with the tax appellate system as litigations take years for settlement of tax disputes. Therefore, in order to make the appellate system more responsive, the existing tax tribunals dealing with direct and indirect taxes need to be restructured.

The above study proposes a two-tier tax appellate system where first appeal goes to National Tax Tribunal with the right of another appeal in the form of intra court appeal. Subsequently, if any substantial question of law needs consideration, it can be referred to the Supreme Court by way of leave to appeal. This will help in achieving uniformity of decisions since at present High Courts in different provinces sometimes differ on identical questions of law and it takes years for final authoritative pronouncement by the Supreme Court. The two-tier tax justice system can ensure expeditious settlement of tax disputes, preferably within a year’s time of first order.

Income taxation at the moment is highly complex and fragmented. There is classical taxation under various heads of income, while many transactional taxes, presumptive and minimum, alternate corporate tax have been added to distort the entire concept of personal income taxation.

Towards Flat, Low-rate, Broad and Predictable Taxes also suggests simple and flat rate taxation of 10 percent or 2.5% of net wealth exceeding Rs. 10 million, for all individuals and for AOPs and companies, 20 percent. It proposes single-stage, single-digit sales tax on goods by federal government at the rate of 8 percent across the board with no exemption, albeit exporters shall have zero-rated regime. The only exemption shall be on food, life-saving drugs, books, children’s garments and educational equipment. Provinces can also consider imposing harmonised sales tax (HST) at the same rate on services, details of which requires a separate study. Alternately, we should move towards a unified sales tax on goods and services through national consensus whereby provinces give right under Article 144 to the National Assembly.

Under the current Customs Act, 1969, exemptions/concessions are granted to goods in three categories under Pakistan Tariff: (i) Fifth Schedule of the Customs Act and Statutory Regulatory Orders (SROs), (ii) Chapter 99 of Pakistan Customs Tariff and (iii) export promotion schemes announced time to time. There are over 5,000 effectively traded tariff lines and 2448 tariff lines (33% are under 20% slab). Heavy taxation at import stage (50% of FBR revenue is collected at import stage) encourages smuggling, undervaluation, misreporting, misdeclarations and tax evasion.

The SRO-based customs policy has rendered the actual tariff different from the standard tariff. As a result of this, customs tariff has multiple rates and several exemptions, and various “conditions and requirements” are to be fulfilled to avail those exemptions. This creates opportunities for the discretionary use of powers by officials, raising the cost of doing business and incentivising malpractices and misdeclarations for evading duties. Recognizing these problems, this paper proposes that there should be a single slab of for all imports to end these undesirable practices.

The traditional approach adopted for decades in Pakistan for balancing the books, levying more taxes, containing fiscal deficit and other number games will have to be reconsidered in totality under the prevalent exceptional circumstances. The only viable option for meaningful change is to replace the existing tax system with simple, low-rated tax on a broad-base, pragmatic and growth-inducive. With such a system in place, those who are not into the tax net or who avoid true disclosures would be encouraged to pay their taxes voluntarily, honestly and diligently.

It will create incentives for better compliance and lead to accelerated economic growth. A paradigm shift is required to restructure the entire tax system to induce more investment, accelerate growth and ensure economic prosperity for the country benefitting all members of society. This should be coupled with transparent and quality spending of taxpayers’ money for welfare of society as a whole and incentivizing growth and economic well-being of every individual.

The nation should demand that all political parties evolve consensus on areas of reforms highlighted by PIDE and many other institutions and individuals. There should be pre-election agreement on one point: We all want to make Pakistan a true egalitarian state as envisaged under the Constitution. For achieving this goal, political parties must debate for comprehensive reforms in all areas pointed out by PIDE with the aim to move towards the cherished goal of self-reliance and becoming a welfare state. It is not possible to make Pakistan a welfare state unless we undertake structural reforms in the prevailing politico-economic system that favours the minority elites against the majority that is less-privileged.

This article was originally published on "The Scoop" on December 19, 2023.

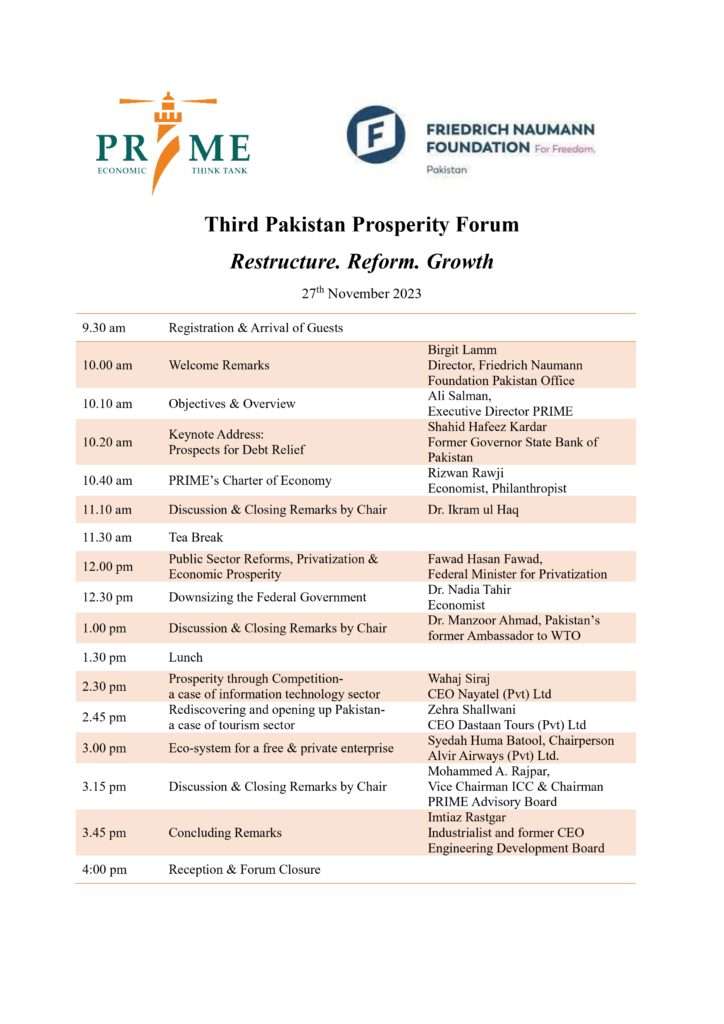

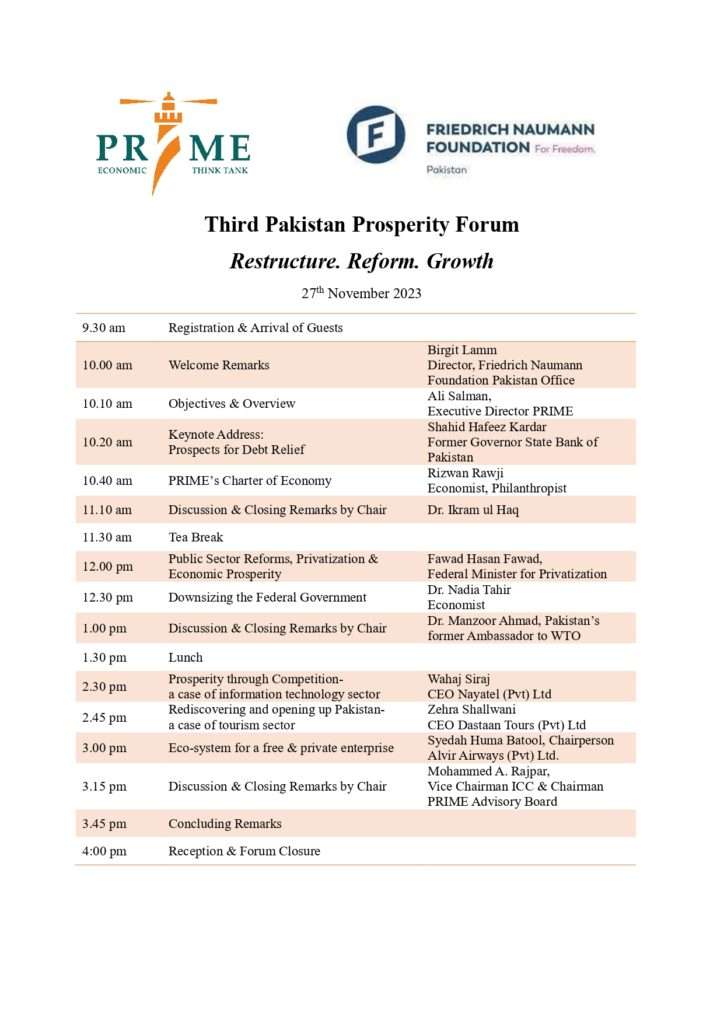

Third Pakistan Prosperity Forum

THIRD PAKISTAN PROSPERITY FORUM

Policy Research Institute of Market Economy (PRIME) hosted Third Pakistan Prosperity Forum, The conference brought together government representatives, IMF officials, business leaders, academics, and media professionals.

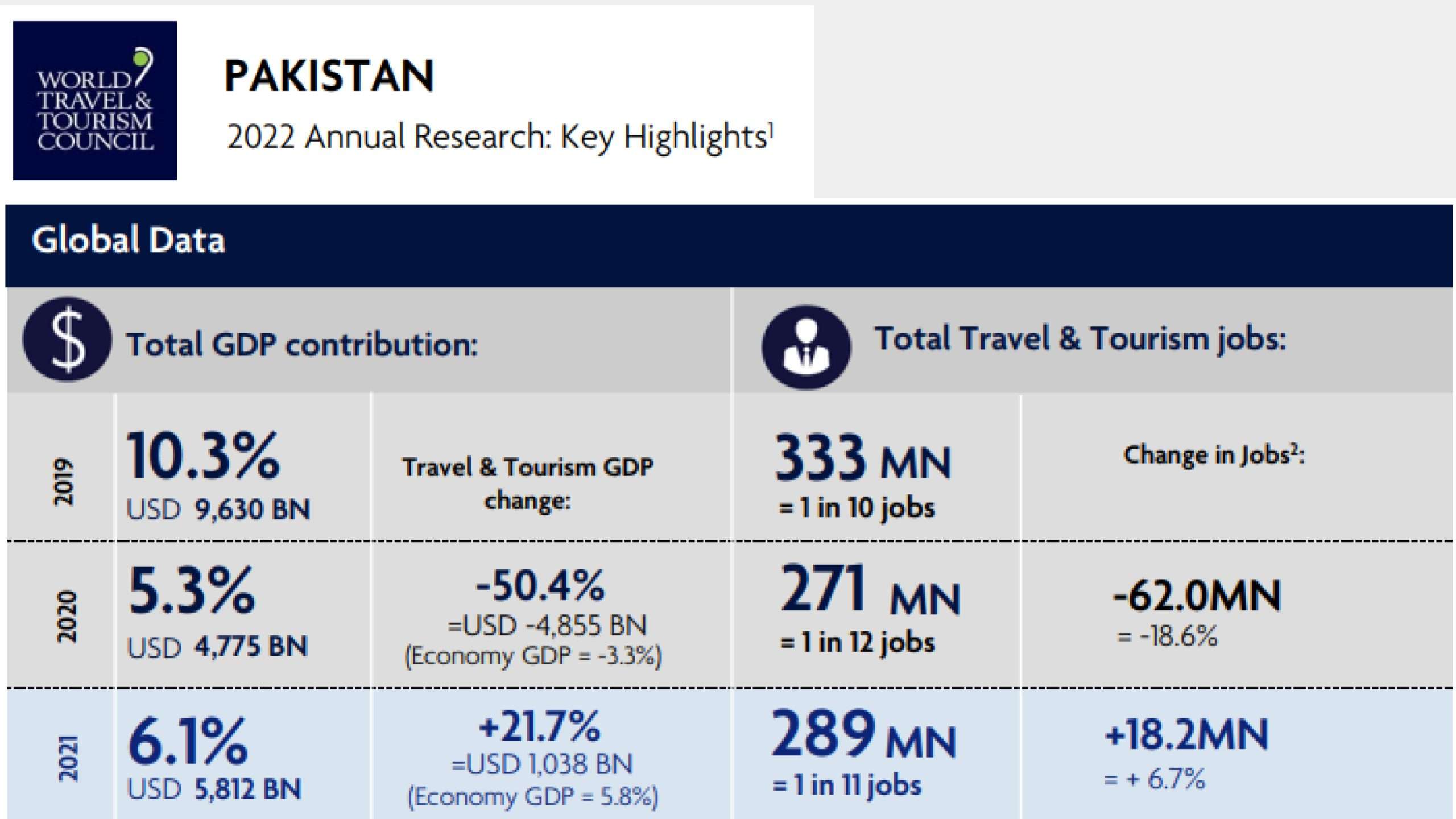

The event fostered discussions on Pakistan’s economic challenges and proposed strategic reforms for sustainable growth. Speakers included Mr. Fawad Hasan Fawad (Federal Minister for Privatization), Ms. Birgit Lamm (Director, Friedrich Naumann Foundation Pakistan office), Mr. Shahid Hafeez Kardar (Former Governor State Bank), Mr. Rizwan Rawji (Economist, Phlianthropist)i, Dr. Nadia Tahir, (Economist), Mr. Wahaj Siraj (CEO Nayatel), Ms. Zehra Shallwani (CEO Dastan Tours), Mr. Imtiaz Rastgar, and session chairs including Dr. Ikram ul Haq (Advocate Supreme Court), Dr. Manzoor Ahmad (Pakistan’s Former Ambassador to WTO) and Mr. Mohammed A. Rajpar offering valuable insights to shape a prosperous future.

Third Pakistan Prosperity Forum 2023

Marriott Hotel, Islamabad, 27 th November 2023

AGENDA

Discussion notes from the conference can be accessed by clicking below.

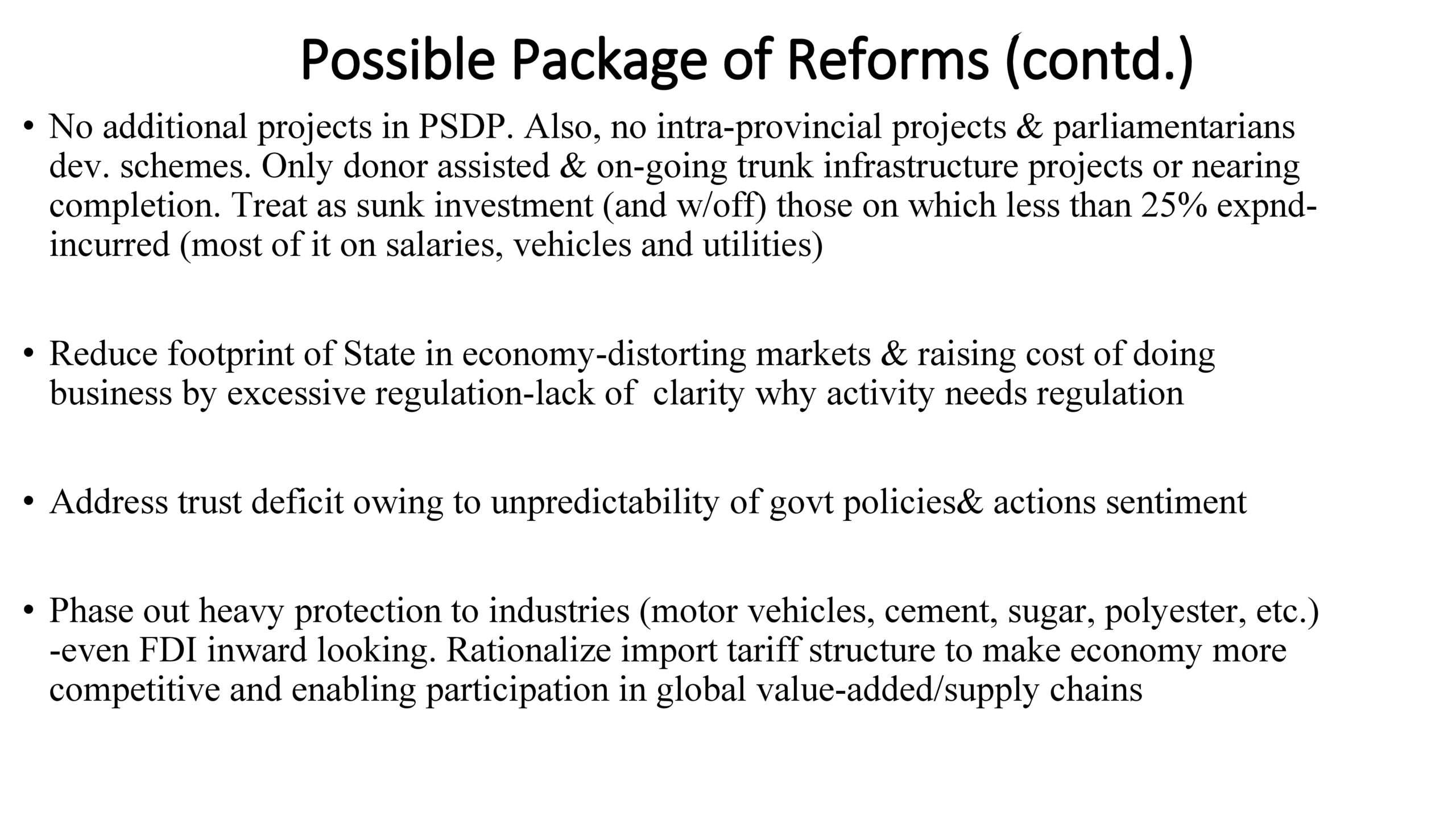

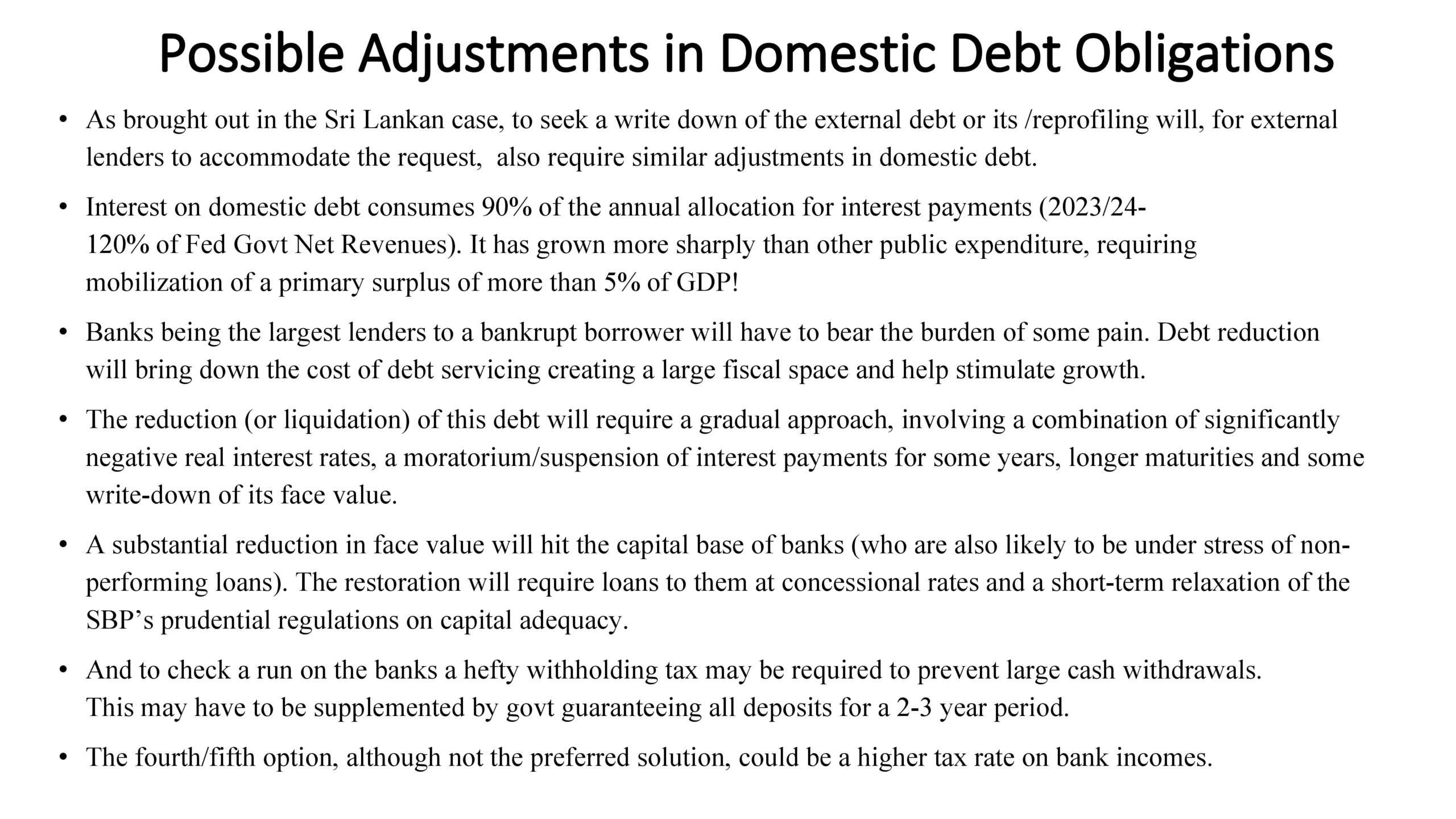

Access the full presentation on “Prospects for Debt Relief” by clicking below.

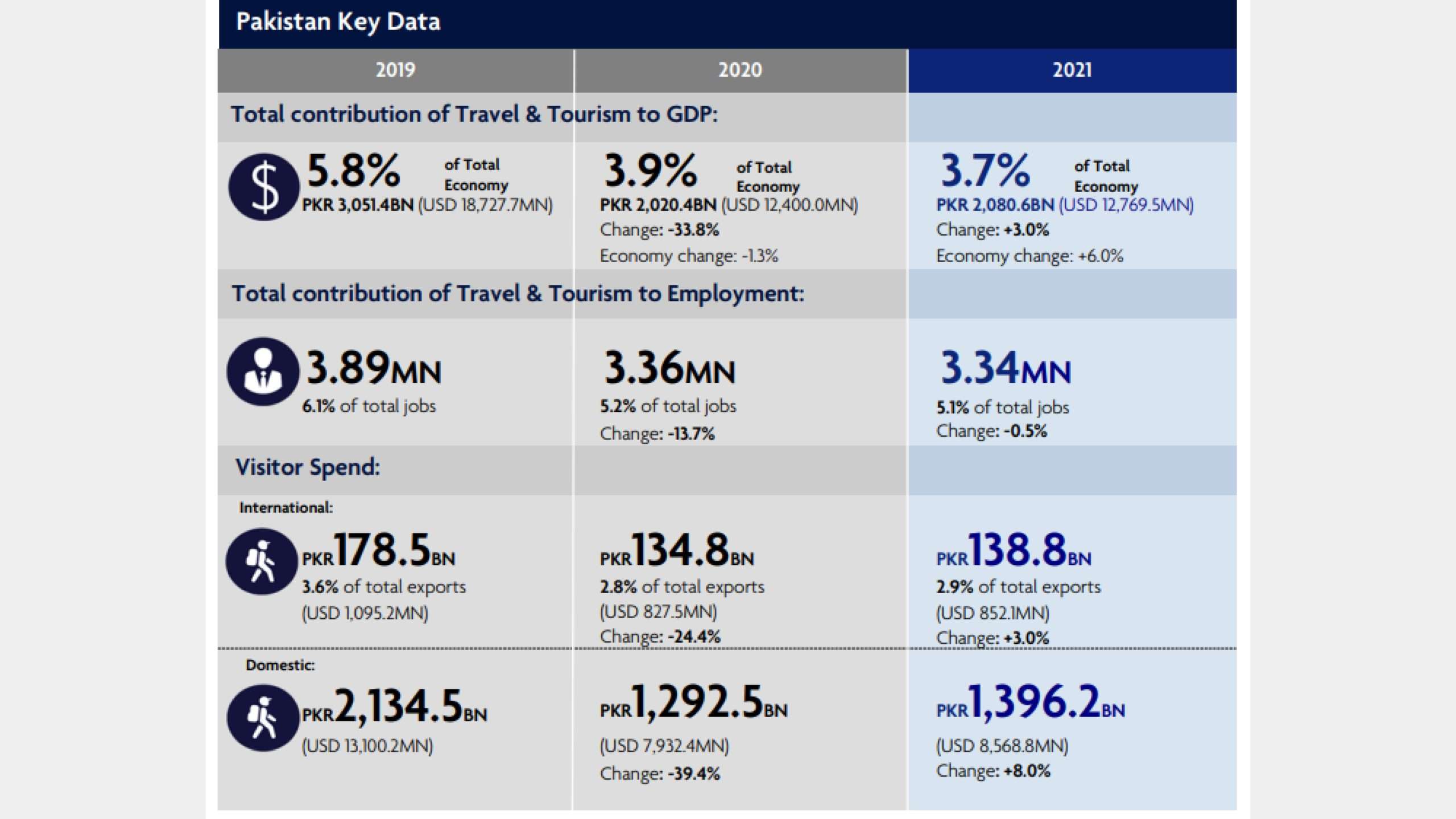

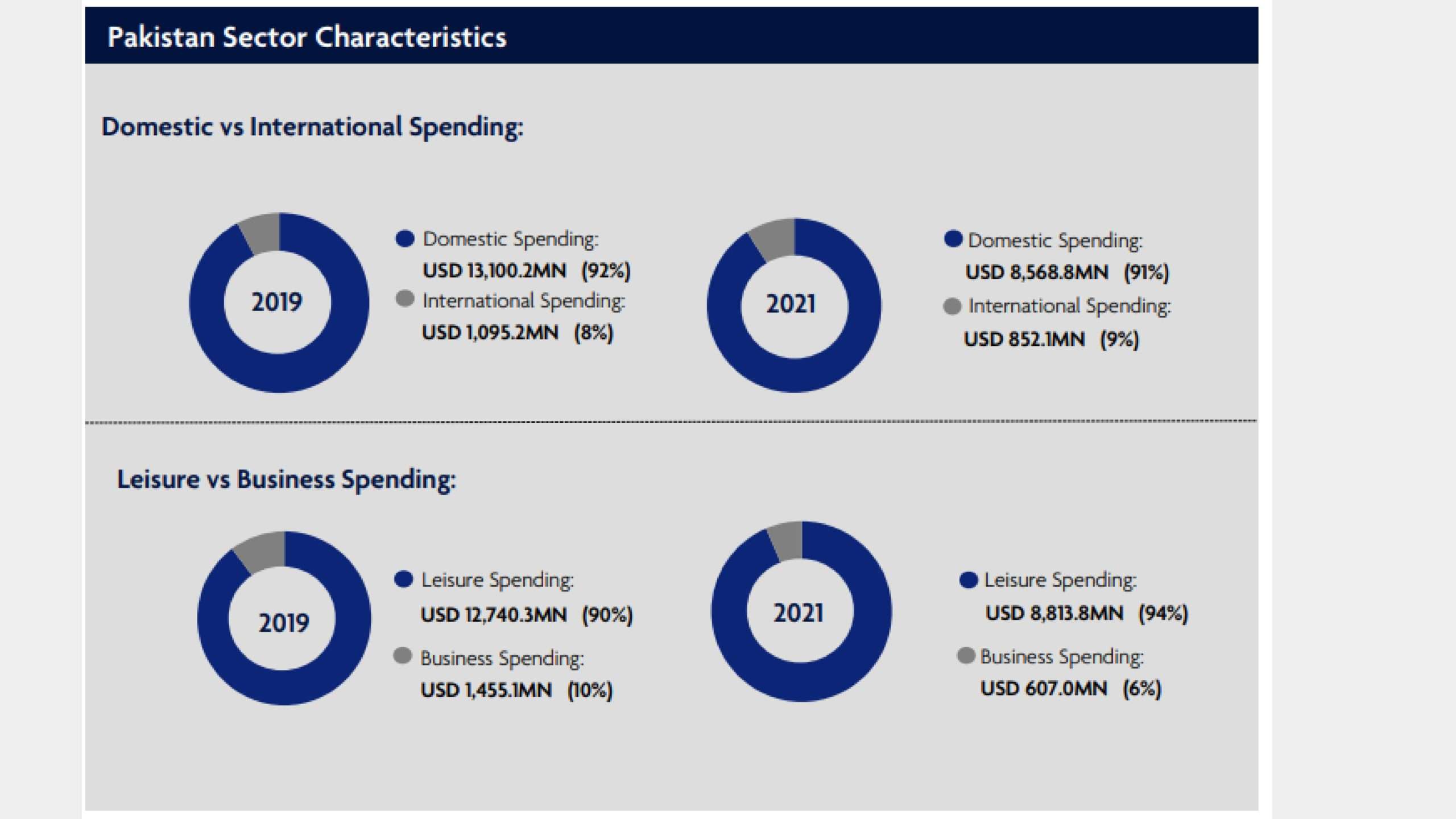

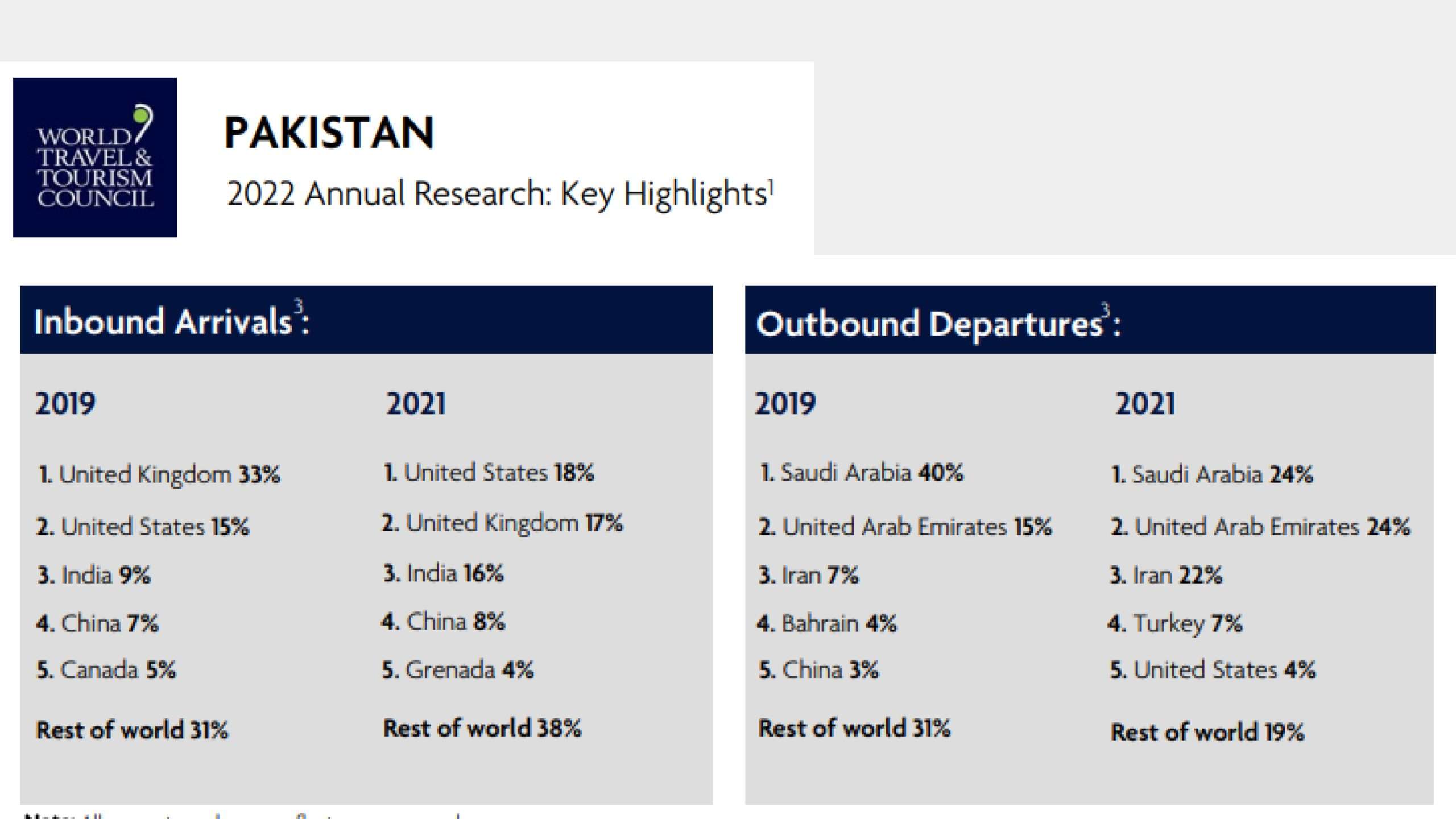

Access the full presentation on “Rediscovering And Opening Up Pakistan A Case of Tourism sector” by clicking below.

Press Release

Highlights:

Revamping taxation system and privatizing SOEs are crucial for economic prosperity

Revamping taxation system and privatizing SOEs are crucial for economic prosperity

The taxation system of Pakistan not only incentivizes people to stay out of the tax system but also contributes to decorporatization, said Mr. Fawad Hasan Fawad – Federal Minister for Privatization, while speaking at the 3rd “Pakistan Prosperity Forum” organized by the Policy Research Institute of Market Economy (PRIME).

In the keynote address, Mr. Shahid Hafeez Kardar- Former Governor State Bank of Pakistan, highlighted that rationalization of public expenditures is crucial for the sustainability of public finances. Dr. Nadia Tahir stressed upon the importance of fiscal prudence by sharing that fiscal spending has not resulted in economic growth in Pakistan.

The Forum was attended by the representatives of the government, IMF, business community, academia, and media.

Speakers presented the diagnosis of the economic challenges by focusing on the debt crisis caused by unrestrained spending and suggested reforms to build an agenda for sustained economic growth.

Mr. Fawad Hasan Fawad informed the audience that the current state of the public sector is unsustainable and contributes to the deterioration in the business environment in the country. In 3 years from 2018-2021, the government spent Rs. 2.54 trillion in terms of subsidies, grants, and loans to keep commercial SOEs operational. The size of the government has increased by more than three times in the last couple of decades.

Mr. Fawad highlighted the flaws in the country’s taxation system by informing that around 93 percent of the collected tax revenue is either voluntary or withholding; whereas, only 7 percent is actually collected by FBR. Moreover, FBR sends recovery notices to individuals worth billions of rupees while the actual collection is a mere few hundred million. Since 2016, the tax burden on corporate taxpayers has increased by more than 40 percent on average. Such a burden has not only contributed to encouraging people to stay out of the tax system but also decorporatization.

The public sector reforms should include bureaucratic reforms and taxation system reforms. These two areas are crucial for improving performance of the state. He stressed that the reform should not increase in the size of the federal and provincial governments, and the power of state functionaries. The reforms also need to focus on building the capacity of the state to regulate markets from where the government exists and the private sector takes over.

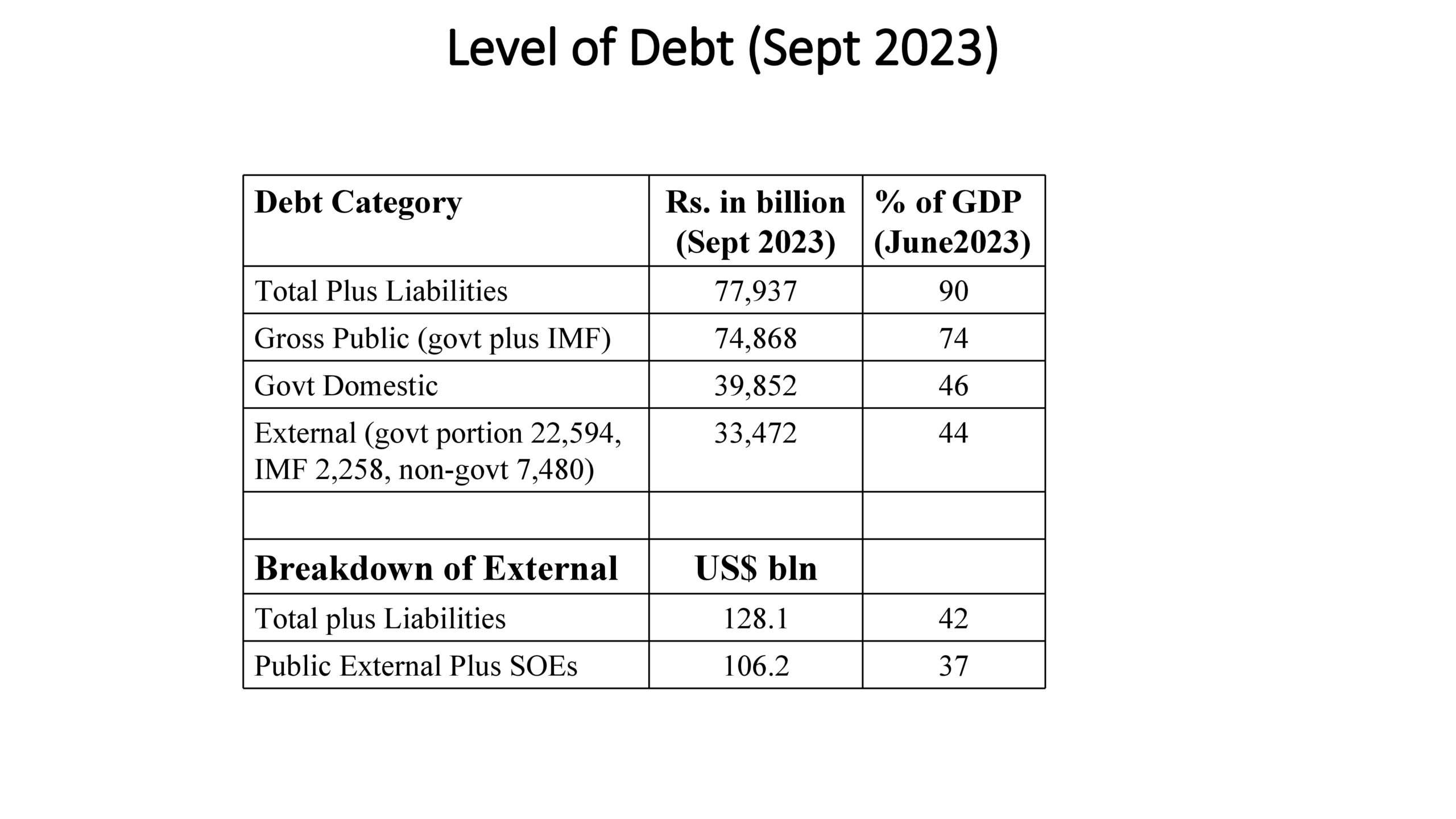

Mr. Shahid Hafeez Kardar highlighted that the wasteful expenditures on low-priority, and poorly designed projects have made the debt unsustainable. While addressing the Forum, Mr. Kardar said that borrowing is not harmful if utilized in productive activities and generating assets. He informed that Pakistan’s Gross Public Debt is 667 percent of revenues, and external debt is 232 percent of exports.

The overhaul of the economy requires rationalization of government expenditures, moving towards a contributory pension system, reducing the footprint of the government in the economy, rationalizing tariff structure by phasing out protection of industries and revamping the taxation system by reducing the rates and number of taxes.

Mr. Rizwan Rawji – Businessmen, presented the Charter of Economy prepared by PRIME and highlighted that political stability and strong political will hold critical importance in promoting economic prosperity. The economic woes such as the balance of payment crisis, unsustainable debt, and inflation are only due to misaligned fiscal policies of the governments. Currently, out of 5 million tax filers, less than 3 million pay tax, and a significant portion of sales tax is collected from a mere 400 entities. Mr. Rawji suggested that reforms envisaged in the Charter of Economy are based on the pillars of economic prosperity, which are: low and broad-based tax rates, spending restraints, low footprint of the government in the economy, privatization of loss-making SOEs, tariff rationalization, and sound money.

Mr. Ali Salman – Executive Director PRIME, remarked that the size of the government and its presence in the economy need to be reduced to improve fiscal sustainability and create an enabling business environment in the country.

The speakers had a consensus that reforms should start from the restructuring and resizing of the government to reduce its presence in the economy. The reforms should be complemented by restricting the public spending and focusing on revamping the taxation system by reducing the number and rates of taxes to broaden the tax base.

For inquiries, please contact farhan@primeinstitute.org or call +92 (51) 8 31 43 38

Upcoming Event: Third Pakistan Prosperity Forum

Third Pakistan Prosperity Forum

Restructure, Reform, Growth

We are excited to announce the upcoming 3rd Pakistan Prosperity Forum: Re-structure, Reform, Growth, organized by the Policy Research Institute of Market Economy (PRIME) in collaboration with the Friedrich Naumann Foundation for Freedom Pakistan.

Event Details:

Date: Monday, 27th November 2023

Time: 09:30 AM to 4:00 PM

Location: Islamabad. Pakistan.

The objectives of Third Pakistan Prosperity Forum are:

1. To present a diagnosis of economic challenges faced by Pakistan with a focus

on public debt crisis, underpinned by unrestrained public spending.

2. To disseminate clear, specific and practical policy messages for economic

reforms, structural reforms and institutional reforms.

3. To bring together stakeholders from the community of economists, policy

makers, entrepreneurs, think tanks, and politicians and to build a consensus

on an agenda for sustained economic growth and better governance.

Speakers include economists, business leaders, policy makers and policy experts.

Program Agenda:

For inquiries or more information, please feel free to reach out to events@primeinstitute.org.

To secure your place, please register by visiting the link below:

Rethinking Pakistan’s export strategy

Rethinking Pakistan’s export strategy

Asking the right questions, focusing on productivity, global competitiveness is key

Ali Salman | 07, November, 2023

Everyone agrees that the only way out of the abyss that Pakistan's economy finds itself every few years is to increase our dollar income substantially. These non-debt creating inflows can only materialise through an increase in exports, investment or remittance. In this article, I will focus on the export part of this equation.

From my perspective, an increased reliance on remittance serves as a disincentive to produce and facilitates only consumption with inflationary impact. Similarly, foreign investment flows are accompanied with liabilities, particularly when they are directed towards infrastructure, such as power and highways. The China-Pakistan Economic Corridor (CPEC) is a case in point.

Over the decades, Pakistan has used various policies, incentives and schemes to enhance exports. The fact that the exports-to-GDP ratio has fallen over time dramatically is a sufficient indicator of the failure of our export paradigm. We touched a maximum of 17% exports to GDP ratio in early 1990s- an era of trade liberalisation and economic reforms, as well as positive trade balance. This ratio today is hardly 10% with a widening trade account gap, where other regional economies have managed to increase this ratio.

We extended all kinds of incentives to the private sector and developed export processing zones in the 1980s. Despite this, to date, their contribution in total exports is less than 3%, compared with Bangladesh where it is above 15%. To determine the causes, the government recently commissioned a study to our institute, and a report has been submitted to the government which offers recommendations on improvements.

The government offered export finance schemes like TERF and LTTF with credit supply at a discount. Additionally, they offered duty drawback incentives to our exporters. These schemes helped to some extent and have proven advantageous for incumbents. Moreover, our product complexity has not improved implying low value that our products get in the international markets. The example set by the veteran Industrialist Imtiaz Rastgar whose products are exported to 130 countries is inspiring but exceptional.

Pakistan has persistently used import substitution policies, even with evidence of their failure. One compelling example is our auto industry, which has not developed any export markets for various reasons and prices remained very high. However, our motorbike industry has become far more competitive and as a result, has offered products at reasonable prices.

In 2013, Pakistan received GSP Plus status from the EU, a trade deal with duty free or minimum tariff barrier access for textile and other products. In her paper, Economist Sarah Javaid concluded that Pakistan took maximum advantage of the scheme, with 97% of the utilisation. However, it did not help in product diversification or supply chain development. Some can argue that it might have created an opposite effect by limiting product diversification.

A new study authored by Aadil Nakhoda and published at the PRIME, an independent economic policy think tank, estimated that the possible trade loss in case of revocation of GSP Plus is over $3 billion per year, though there are some estimates which put this possible loss closer to $6 billion. Roughly around 30% of our exports fall under GSP Plus. In comparison, the Philippines, which is another GSP Plus country with overall exports of above $115 billion, has only $2.5 billion exports under GSP Plus, which means that hardly 2% of its exports are dependent on GSP Plus.

When it comes to exports, there is one major policy omission that Pakistan has made, free trade and regional trade blocks. Pakistan has seven PTA/FTAs, though they lack depth, an FTA implies zero duties on 90% of tariff lines, as argued by the former WTO Ambassador Manzoor Ahmad. Therefore, they have not created results which other countries such as Turkey and Vietnam have experienced. Both the countries with more or less similar export level as that of Pakistan hardly thirty years ago shunned protectionism. Since then, they have become export power houses, with Vietnam crossing $350 billion and Turkey above $250 billion.

While there are other factors which have impeded our export potential, I will not discuss them here.

Pakistan requires a new export paradigm. However, for that we have to change the questions we are asking. Instead of asking how we can increase our exports, we should ask ourselves how we can increase our productive capabilities, product quality and competitiveness at the firm level. An isolated focus on exports, through all well-intentioned incentives, is the most important cause of our failure. Once we realise that exports are a part of a greater economic landscape, and can only be enhanced by starting transformation, as we argued in the EAG vision document, we can begin to find answers.

This article was originally published on The Express Tribune on November 6, 2023.

Without structural reforms, SIFC will not succeed

Without structural reforms, SIFC will not succeed

The mandate of Special Investment Facilitation Council (SIFC) neither include institutional reforms nor simplification of procedures despite the acknowledgement that complexity of business regulations and bureaucratic hurdles are the reasons behind dismal state of economy.

Reforms should start from the government departments to create ease for the Pakistani entrepreneurs and improve provision of public services instead of creating new councils and adding more complexities. Creation of a parallel body to expedite the decision making process and requisite approvals may not be a sustainable solution until the concerned government departments are reformed.

PRIME has published its quarterly assessment report, PRIME Plus October 2023, which analyzes the efficacy of the Special Investment Facilitation Council (SIFC), the macroeconomic performance of the country in Q1- FY2024, and potential challenges.

The report scrutinizes the establishment of SIFC which the government has proclaimed as its “Plan B” to overcome the recurring balance of payment (BoP) crises by attracting foreign investment in the country. SIFC has identified projects in 4 sectors: Agriculture, Mining and Minerals, I.T., and Energy. The establishment of SIFC under the umbrella of the BOI with separate management and objectives highlights the acknowledgment of the failure of BOI by the government and the need to have an alternative body.

The report “Prime Plus” concludes that the efficacy of SIFC as a “Plan B” needs to be evaluated meticulously. The inefficiency of BOI has failed to prompt the government towards carrying out institutional and regulatory reforms that have been responsible for the reluctance of foreign investors. The establishment of SIFC indicates that the government has neglected to address the bureaucratic hurdles and associated inefficiencies.

The report highlights that the policy environment of the country is unconducive for business growth. The

frequent changes and the repetition of ineffective policies have weakened the interest

of foreign investors.

The local business community is excluded from the decision-making process and no effort has been made to mobilize domestic resources. The structure and objectives of SIFC are unclear. Moreover, higher involvement of the military in decision-making and implementation will not be help to restore investment climate, which require deregulation and tax reforms.

The country’s economic performance has remained unsatisfactory while external financial obligations continue to mount. Against the target of 3.2 percent GDP set by the government, international financial institutions have downgraded their forecasts to around 2 percent. On the external front, the financial obligations in FY 2024 are around $28 billion. On the domestic front, the government faces a significant financial burden as 79 percent of the expected FBR revenues will be spent on debt servicing while leaving little space to carry out other expenditures.

Inflation continues to remain a challenge and people have experienced an exponential fall in their purchasing power. The CPI inflation stood at 31.4 percent in September 2023 while average CPI inflation in Q1 FY 2024 cloaked at 29 percent. The government’s decision to pass on the cost of utilities to the consumers without addressing policy and institutional inefficiencies may prove to be futile and keep inflation unanchored.

The political environment in the country remains uncertain as the schedule of elections is still not announced by the Election Commission and rumors about delays continue to prevail. Political stability is likely to improve when elections are announced. The crackdown started by the government against deviants in the currency and gold markets to curtail smuggling will not bear fruit unless policy uncertainties are addressed.

For inquiries, please contact farhan@primeinstitute.org or call 0331-5226825

Tax Payers Alliance Pakistan (TPAP) submits Proposals to Task Force on Tax & FBR Reforms

Tax Payers Alliance Pakistan (TPAP) submits Proposals to Task Force on Tax and

FBR Reforms

TPAP| October 24, 2023

Federal Board of Revenue (FBR) constituted a Task Force on Tax & FBR Reforms vide notification dated 27th September, 2023. The purpose of this Task Force is to suggest measures regarding the improvement of FBR efficiency. As per TORs of the Task Force, it will review FBR & tax collection data, performance indicators, and access to data. It will also address tax evasion, smuggling, and corruption, propose structural reforms for the tax administration, and suggest technology-based measures to enhance tax collection. It will analyze tax policy, examine tax expenditures, and recommend the use of information technology for better compliance and transparency. The Task Force will submit a comprehensive report to the Government, outlining revenue and policy reform measures, including potential changes in tax administration and laws.

Tax Payers Alliance Pakistan (TPAP) – an initiative of economic think tank PRIME, in order to discuss and deliberate on related issues called a meeting of its members on 6th October 2023, who participated actively to share their ideas to be presented to the Task Force. On the basis of said meeting, TPAP

finalized proposals and submitted to the Task Force on 19th October, 2023. Proposals submitted by TPAP aim at reforming the taxation system in Pakistan to promote simplicity, transparency, and compliance; to eliminate taxes that are unjustified, discriminatory and have become redundant; and to create a fairer and more efficient tax system in Pakistan that can provide sustainable funding for public expenditures.

TPAP, the brainchild of PRIME, developed these proposals in consultation with its members, comprising of tax experts, development consultants, researchers, scholars, people from business community and salaried individuals from across Pakistan. The meeting was led by Mr. Ali Salman, Executive Director PRIME, Mr. Anas Farhan, Convener TPAP Secretariat Islamabad and Mr. Usman Azmat, Convener TPAP Lahore Chapter.

[pdf-embedder url=”https://primeinstitute.org/wp-content/uploads/2023/10/TPAP-proposals-submitted-to-Task-Force-on-Tax-FBR-Reforms.pdf” title=”TPAP proposals submitted to Task Force on Tax & FBR Reforms”]

Incredible things happen when taxpayers come together and raise their voice to bring betterment in the taxation system.

Click below to get the full meeting rundown.

Cryptocurrency Phenomenon: A Paradigm Shift in Global Finance

Cryptocurrency Phenomenon: A Paradigm Shift in Global Finance

Bilal Zahid| October 17, 2023

In our contemporary landscape, a ground-breaking financial innovation has emerged - the realm of cryptocurrency. This digital alternative to conventional currency possesses the potential to reshape the global economic panorama. While sceptics often label it speculative or akin to gambling due to its notorious volatility, this judgment is predominantly a consequence of its current lack of regulation and low acceptance compared to fiat currencies. However, with proper regulation and universal acceptance, it could achieve stability at par with traditional currencies.

The cryptocurrency phenomenon is intricately linked to the rise of decentralized finance and is far more than just a financial fad. Its transformative potential lies in its ability to disrupt and reshape the economic system on a global scale. From limiting money supply to crowdsourcing computing power, improving e-governance, and enabling digital contracts, cryptocurrencies offer unique solutions to age-old challenges.

Bitcoin, the pioneering cryptocurrency introduced in 2009 by the pseudonymous Satoshi Nakamoto, has been followed by numerous cryptocurrencies, each offering unique features and serving various purposes. While central banks worldwide are presently attempting to introduce their own Central Bank Digital Currencies (CBDCs), it must be noted that these CBDCs lack the fundamental features inherent to cryptocurrencies such as decentralization and democratization. In essence, they constitute only a slightly enhanced manifestation of conventional digital banking.

Decentralized finance marks a paradigm shift and revolutionizes finance by eliminating traditional intermediaries, enabling direct transactions, lending, borrowing, and trading among individuals through smart contracts and decentralized applications, without centralized institutions like banks. It offers the potential to address chronic economic challenges, especially in developing nations like Pakistan. Many economic upheavals witnessed worldwide over the past century has been precipitated by unwarranted governmental actions stemming from centralized control. Instances of misguided priorities, political agendas, short-sightedness, and miscalculations have served as triggers for economic debacles and rampant inflation.

The unrestrained printing of money represents a significant challenge for numerous economies today. This approach fosters uncertainty and a lack of fiscal restraint. In contrast, decentralized currencies eliminate this risk by being programmed with a fixed supply, predetermined quantity, and annual supply increase that cannot be altered. Adherence to a transparent issuance protocol makes decentralized currencies a bulwark against excessive government printing, potentially curbing inflation and promoting financial stability. This implementation alone can significantly reduce the threat of rampant inflation and provide clear guidance to economic managers and businesses.

At the core of the cryptocurrency realm lies blockchain technology, dependent on a decentralized network of computers for transaction validation, a process known as mining. Miners use computational power to solve complex puzzles, ensuring blockchain integrity through Proof of Work (PoW). Cryptocurrency efficiency thrives on crowdsourced computing power. Unlike centralized systems, cryptocurrencies use a distributed network of miners, enabling anyone with access to computing power to participate in securing and validating transactions. This inclusivity defines cryptocurrency networks, democratizing the system and rewarding contributors from all backgrounds.

Furthermore, incentivizing computing power opens intriguing possibilities for economic growth, especially in remote areas. People can profit from harnessing cheap and small power sources in such regions, potentially transforming connectivity without costly infrastructure investments. Small-scale, affordable, and abundant power generation can seamlessly integrate into the national system, reducing the need for substantial transmission line investments.

An equally, or perhaps even more important benefit of this technology, is the implementation of smart contracts, especially in Pakistan, where commercial dispute resolution processes are slow and inefficient, hindering market-oriented enterprises and discouraging domestic and foreign investment. The judicial system is overwhelmed with over two million cases, with a third related to commercial disputes, highlighting the government's inability to enforce contractual obligations effectively.

On the other hand, cryptocurrencies can streamline the use of smart contracts. These contracts are automated and self-executing, with terms written in code, eliminating the need for intermediaries, reducing costs, and ensuring contract enforcement. This innovative approach has profound implications in Pakistan, where legal disputes often last five to ten years. This transformative shift offers individuals and businesses a more efficient and reliable framework for conducting commercial affairs.

Few studies have identified the presence of a Pareto distribution within cryptocurrencies realm, akin to traditional fiat currencies, where a minority holds a substantial share of the wealth. Critics argue that this concentration of wealth contradicts the principles of egalitarianism and decentralization. It is imperative to clarify, however, that decentralization does not inherently advocate for absolute wealth equality among all participants; rather, it promotes the distribution of power and control. Those who exhibit greater resource productivity will inevitably see their wealth grow, a universal truth regardless of the specific currency system at play.

The concept of decentralization should not be misconstrued or dismissed as undermining the myriad benefits it offers. Despite the challenges associated with embracing decentralized currencies, their adoption is inevitable. As the evolution of Web 3.0 continues, characterized by greater decentralization and personalization, the use of microtransactions is set to increase significantly. Leading social media platforms such as Facebook are actively pursuing the development of their unique digital currencies, aligning with the ongoing technological shift towards a more decentralized web. As a result, the adoption of cryptocurrencies is anticipated to experience substantial growth.

In the face of these dynamic developments, the establishment of a regulatory framework poses a formidable challenge. Nevertheless, it remains of utmost importance for governments to take proactive steps in crafting a policy framework that not only serves as a regulatory mechanism but also positions them as frontrunners in embracing this emerging phenomenon. Such a strategic approach will not only expedite the development of essential ecosystem but also foster the growth of IT human resources necessary for assuming leadership roles on the global stage. This will enable them to become centers of competence and service excellence within this evolving paradigm.

Bilal Zahid is a experienced telecom professional and an independent thinker. He has written this article exclusively for PRIME's Website.

Eighth Islamabad Policy Exchange

EIGHTH ISLAMABAD POLICY EXCHANGE

12th, Oct 2023

PRIME (Policy Research Institute of Market Economy) organized the 8th Islamabad Policy Exchange on 12th of Oct 2023. The event was attended by policy practitioners from the government, chambers, researchers and field experts. The Islamabad Policy Exchange is a forum for candid discussions for policy stakeholders, held under Chatham House rules The discussion explored a groundbreaking stride towards elevating trade efficiency - the Pakistan Single Window (PSW).

Pakistan's trade environment faced significant challenges curtailing from a complex and fragmented regulatory system. With more than 50 government agencies overseeing trade, each with its own set of rules, compliance became a cumbersome task for businesses. Furthermore, outdated, manual, paper-based processes led to delays, errors, and even corruption, hindering the efficiency of trade operations. The absence of transparency and effective coordination among these agencies compounded the problem, making it arduous for businesses to monitor their shipments' progress and address any emerging issues promptly.

PSW has revolutionized trade in Pakistan. By consolidating multiple agencies into a single platform, it simplifies trade processes. Automation and digitization have brought about greater efficiency and transparency, reducing errors and expediting procedures. Businesses can now track shipments in real-time, facilitating prompt issue resolution. Additionally, the PSW encourages collaboration among government agencies, eliminating duplication and enhancing the overall trade experience. This transformative initiative is poised to escort in a new era of trade facilitation, reshaping the very essence of how trade functions in Pakistan.

The scope of the PSW encompasses the entirety of cross-border trade, including B2G, B2B, and G2B processes, with the potential to save $430 million annually. Services provided include Online Evidence of Identity, FBR, PMD, NADRA, Banks, SECP, and have engaged 71,000 users. The platform integrates 29 commercial banks and facilitates E-Trade across various government departments and agencies. Upcoming endeavors involve implementing an AI/MLP-based Integrated Risk Management System, supporting Government Agencies (GAs) in automation, establishing a PSW Trade Lab, fostering public and private sector partnerships, and leveraging Big Data and Data Analytics.

Pakistan PSW has re-engineered 111 processes, replaced 83 documents with electronic verification, transitioned 145 documents to electronic submission, and eliminated a total of 46 documents. In Pakistan, regulations are applied to 67% of all import goods declarations (GDs) and 12% of all exports. The PSW is addressing these challenges head-on by simplifying trade processes and implementation digital solutions.

The PSW has made significant progress, but further expansion to include more government agencies is crucial to address remaining regulatory complexities.

The establishment of a PSW Trade Lab can serve as a center for innovation, research, and continuous improvement. This would provide a platform for developing and testing new solutions, technologies, and strategies that can further enhance trade facilitation. Leveraging Big Data and Data Analytics is vital for identifying trends, streamlining processes, and making informed decisions to optimize trade.

The PSW must adapt to evolving business needs and the global trade landscape. By expanding agency participation, improving risk management, promoting collaboration, fostering innovation, and using data insights, it can enhance trade efficiency and transparency, benefiting both businesses and the economy. This ongoing commitment ensures the PSW remains pivotal in reshaping trade in Pakistan for greater effectiveness and receptiveness.

For inquiries, please contact farhan@primeinstitute.org or call at +92 (51) 8 31 43 38

Seventh Islamabad Policy Exchange

Seventh Islamabad Policy Exchange

Islamabad: Speaking at the 7th Islamabad Policy Exchange marking the launch of a report titled “Pakistan and EU Trade Potential: The Bottlenecks and Roadmap for Reforms,” the author Dr. Aadil Nakhoda emphasized the urgent need to safeguard Pakistan’s GSP Plus status, as its revocation could result in a loss of more than $3 billion for Pakistan, further exacerbating the country’s balance of payment challenges.

The report, which was published by the Policy Research Institute of Market Economy – PRIME, in partnership with the Friedrich Naumann Foundation delves into critical aspects of international trade between Pakistan and the European Union, shedding light on the consequences of the potential revocation of GSP Plus status and offering crucial recommendations for policymakers and businesses.

Dr Nakhoda stated that Pakistan must broaden its product range and enhance product quality to tap into untapped markets within the EU as strategic diversification holds great significance.

While analyzing unit value and Revealed Comparative Advantage (RCA) data, the author highlighted the success stories of Vietnam and India in exporting high-value, quality products, stating that Pakistan must prioritize consumer satisfaction in export markets.

The report underscored the importance of improving the regulatory environment and promoting ease of doing business.

In his findings, Dr Nakhoda found that the regulatory structure is complex and creates distortions, raising the cost of doing business. He stressed that in order to promote exports, it will be critical to eliminate regulatory hurdles and reduce the operational costs of firms.

He also highlighted that Pakistani exporters need guidance and education regarding evolving international standards and compliance requirements so that domestic producers can improve their processes and adhere to quality benchmarks.

The report notes that a narrow export basket and limited market diversification are among the causes of Pakistan’s low export earnings. It recommends that Pakistan must not only diversify its exportable goods but also graduate to higher value-added products. Exporters need to explore unconventional markets to increase their earnings.

In this regard, Dr. Nakhoda pointed towards the expansion of two critical initiatives: the Pakistan Single Window and the National Compliance Center, to facilitate exports and enhance integration into global value chains.

The report also notes that female labor force participation remains low and calls for concerted efforts to empower women and harness their potential.

The report highlighted the importance of SMEs and their potential in promoting industrialization and exports of the country. Currently, policies are inclined towards promoting large scale industries while negligent attention is paid to facilitate SMEs. To embark on a growth trajectory and escape vicious cycle of balance of payment crises, it is crucial to promote SMEs by reducing regulatory hurdles.

Click here to access the recording

For inquiries, please contact farhan@primeinstitute.org or call at 03315226825

Pakistan & EU Trade Potential: The Bottlenecks and Roadmap for Reforms

PAKISTAN & EU:TRADE POTENTIAL

The Bottlenecks and Roadmap for Reforms

[wpdm_package id='79466']

Trade plays a vital role in driving economic growth, but Pakistan’s trade performance has been volatile, with stagnant export growth and a rising trade deficit. The Generalized Scheme of Preferences (GSP) Plus is offered to a select group of exporters to the European Union (EU) based on a set of pre-defined criteria and the fulfillment of various conventions regarding human rights, labor rights, good governance, climate change and environment protection. Pakistan received the status on January 1, 2014. Pakistan currently is a signatory to all the 27 conventions and is also a signatory to the additional conventions proposed under a new revised scheme that is likely to replace the current one that is expiring at the end of this year. Although, Pakistan is not in imminent danger of losing the preferences awarded to its exporters, uncertainties loom as Pakistan faces challenges that can adversely impact its status. While Pakistan has experienced growth in trade with the EU during the GSP Plus period, it is imperative that the exporters continue to receive the preferences. To fully exploit trade potential and effectively compete with counterparts, it is essential to assess the trade patterns. This report undertakes a comprehensive exercise to not only determine the trading patterns with the EU but also bring forward recommendations that can help boost Pakistan’s exports to the EU and to the world.

This study outlines and evaluates the pattern of imports into the European Union (EU) from Pakistan, highlighting not only on the significance of the trading relationship between the EU and Pakistan but also emphasizing on the potential threats and risks if the preferences to Pakistani exporters offered through the GSP Plus Scheme are revoked. The main objective of this report is to identify the bottlenecks hindering trade growth between Pakistan and the EU and propose

reforms to enhance bilateral trade relations such that Pakistan can benefit more from the GSP Plus scheme. The study undertakes a comparative analysis as it considers the trade patterns between the EU and Bangladesh, India and Vietnam. These three countries are major regional counterparts that are likely to influence the trading relationship between Pakistan and the EU.

Pakistan is the largest beneficiary of the GSP Plus scheme. The EU imported $9.1 billion from Pakistan in 2021, increasing from $5.4 billion in 2013. More than $6 billion of the imports in 2021 were under the GSP Plus preferences. The largest industry was the textile industry, accounting for approximately 80 percent of the imports. While imports into the EU from Pakistan in rice has increased significantly since 2017, the imports in leather have decreased. The share of leather products in imports decreased from 10 percent in 2013 to 5 percent in 2021. Further, the set of top market destinations in the EU for the four Asian countries is approximately the same, suggesting that import demand is likely to be generated from within these markets. This highlights the need to emphasize product diversification. Analysis on the patterns of imports in other non-traditional industries is crucial for policymakers seeking export diversification. This study further considers four major products from industries which are not traditionally export-oriented in Pakistan, namely denatured ethy-alcohol, medical instruments, inflatable balls, and footwear as products in which Pakistan has shown relatively higher potential in terms of trade with the EU.

This report presents various challenges with the help of different trade indicators. For instance, Pakistan reports higher values of revealed comparative advantage in the exports of textile products, leather products and rice, but Pakistan and Bangladesh report relatively lower unit values, particularly in the exports of textile products to the EU. Indian and Vietnamese exporters are less likely to compete against Pakistan in terms of the unit value of imports into the EU, while Pakistani exporters may face competitive pressures from Bangladeshi exporters. Further, this report considers the imposition of technical non-tariff

measures and the degree of regulatory convergence achieved towards those imposed by the EU. Although the indicator on the adoption of NTMs scores high for the Asian counterparts of Pakistan, the indicator on regulatory convergence scores low for all countries. Pakistan with low frequency and coverage of technical NTMS, lacks technical NTMs on its imports. This suggests that Pakistan does not impose pre-defined measures to counter the imports of substandard and dangerous goods into the country as observed in its counterparts, which has implications on quality of goods imported and produced in Pakistan. Customs and transport-related firm-level obstacles are briefly discussed towards the end of the report. Pakistani firms are the most constrained in this aspect.

One of the more important findings highlighted in this report is that the revocation of the GSP Plus status will lead to a trade loss of more than $3 billion, with significant loss in exports of bed linen, and men’s and women’s trousers. The biggest market affected will be Germany. The loss of $3 billion is significant as Pakistan faces critical balance-of-payment related challenges. Hence, it is crucial that all efforts are made to ensure that Pakistan complies with all the requirements to continue with the status. The loss of status will have a profound impact on the economy.

- « Previous Page

- 1

- …

- 4

- 5

- 6

- 7

- 8

- …

- 30

- Next Page »