Pakistan Economic Freedom Audit -Report Launch

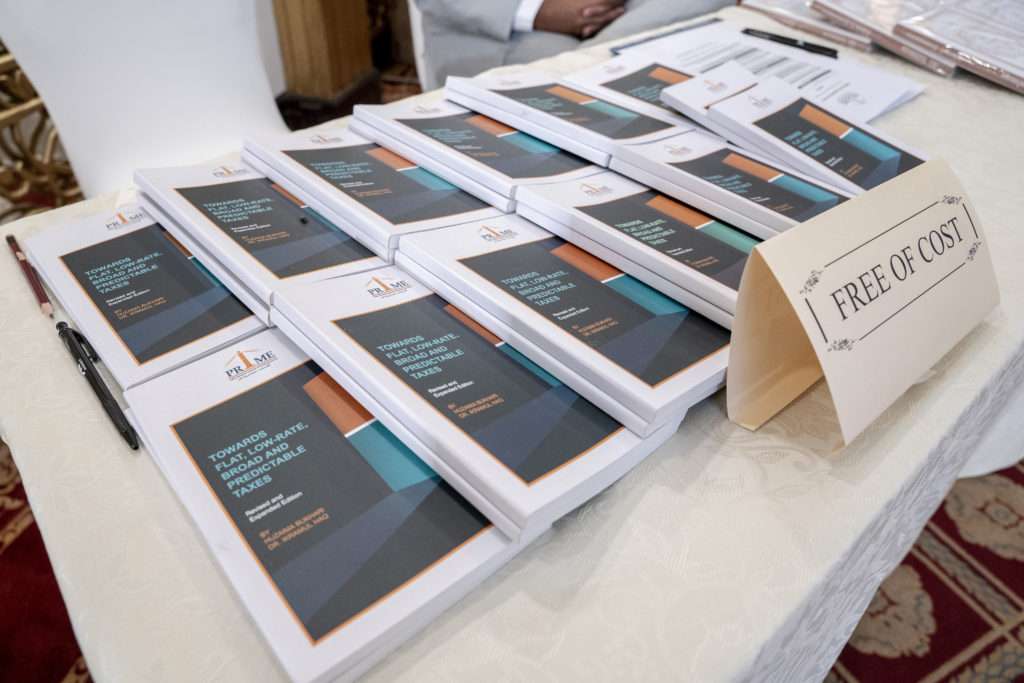

The Policy Research Institute of Market Economy (PRIME), in collaboration with the Atlas Network, hosted a report launch event for the ‘Pakistan Economic Freedom Audit: Sound Money as a Case Study.‘ on 29th, March 2024.

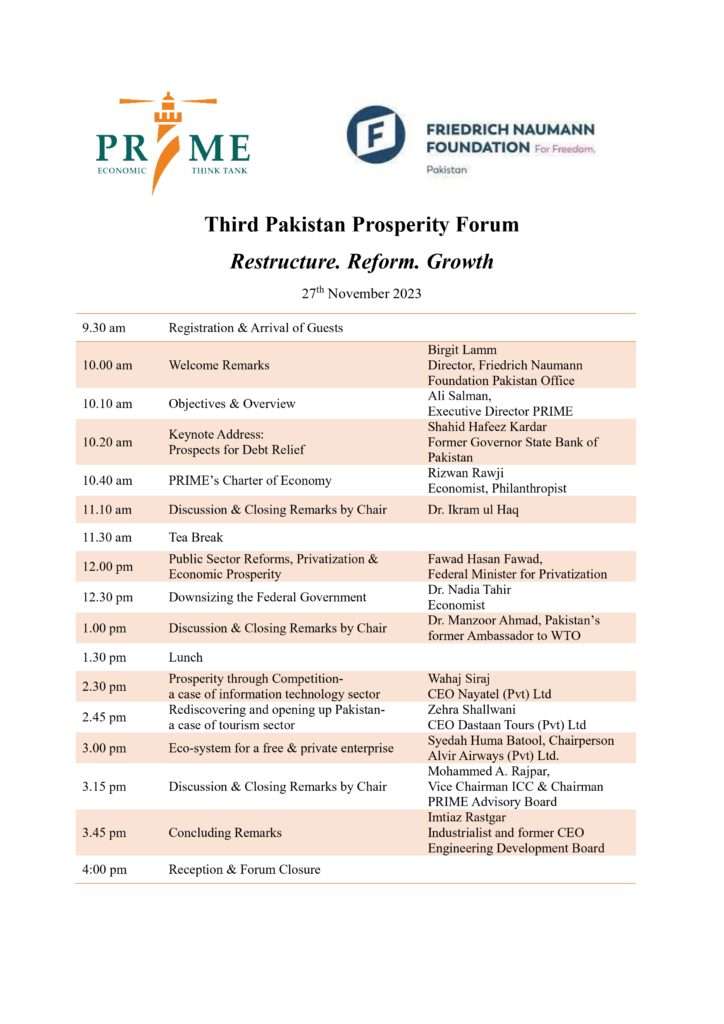

The event featured speakers including Dr. Ali Salman, Executive Director of PRIME, Dr. Wasim Shahid, the report author, and Dr. Nadia Tahir, Economist. The audience included a diverse group of professionals from academia, government, media, and field experts.

Image Gallery

Access the Report:

To read the full report “Pakistan Economic Freedom Audit: Sound Money as a Case Study,” click below:

Read The Press Release:

Click below for more details: