Prime Note: Federal Budget 2022-23

By Tuaha Adil

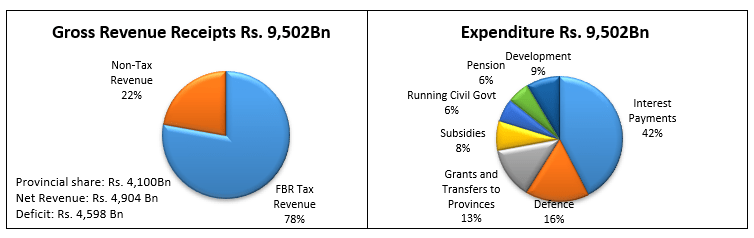

- Federal budget highlights the adoption of a contractionary fiscal policy for sustainable growth. The priority of the government is to stabilize the economy and control inflation as countries around the world are experiencing rising commodity and petroleum prices. The stabilization of the economy is imperative for sustainable growth because country experienced higher fiscal and current account deficits in the last fiscal year. The relief package announced in February deteriorated the sustainability of the economy; contributed to a significant burden on the national exchequer, a rise in fiscal deficit and current account deficits, and currency devaluation. The federal government expenditures for FY 2023 are kept at the level of FY 2022 i.e. Rs. 9,502 billion. However, the budgeted government expenditures for FY 2022 were Rs. 8,487 billion and actual spending increased by Rs. 1,015 billion to Rs. 9,502 billion. Therefore, the government needs to ensure it does not spend more than the budgeted amount.

- The government believes that controlling public expenditures will help in reducing the aggregate demand and inflation. Inflation remains a challenge for the government, which requires a prudent mix of fiscal and monetary policies. In May 2022, the State bank of Pakistan increased the policy rate by 150 basis points to an ever high of 13.75 percent to discourage extravagance and reduce the mounting pressure on the domestic currency. However, raising the policy rate alone remained futile to control inflation and contributed to an increase in the domestic debt liabilities. The average inflation in FY 2022 remained at 11.2 percent and the government has set a target of 11.5 percent for FY 2023, which highlights the fact that the reversal of relief package and passing on the prices of electricity and petroleum products will result in a significant increase in inflation in the short term until the people alter their spending behaviors.

- The budget maintains a significant allocation of funds for subsidies. In FY 2022, the government allocated Rs. 682 billion for subsidies but actual spending was 122 percent higher amounting to Rs. 1,514 billion. In FY 2023, the government has allocated Rs. 699 billion in terms of subsidies, which is higher than the budget for running a civil government. The power sector will receive a major proportion of subsidies amounting to Rs. 570 billion and allocation for the petroleum sector is Rs. 71 billion. The continuity of subsidies without any analysis of the outcome of subsidies poses a serious threat to the financial stability of the country.

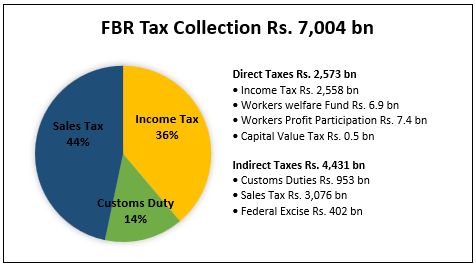

- The government has set an ambitious target of collecting Rs. 7,004 billion as FBR revenues on the back of adjustment in the rates of taxes. The share of direct taxes is 37 percent while the share of indirect taxes is 63 percent, whose incidence is more among people in lower-income groups. Income tax constitutes a major proportion of the direct tax and its share in total FBR revenue is 39 percent. The government envisages an18 percent increase in income tax revenues compared to the last fiscal year. Sales tax constitutes a major proportion of indirect taxes and total tax revenues with a share of 44 percent. The government estimates indicate an increase of 23 percent in sales tax compared to the previous fiscal year. With an expected rise in inflation, there is a possibility of a slowdown in aggregate demand and a subsequent fall in expected sales tax revenues. The tax to GDP ratio proposed in FY 2023 is 9.2 percent, which is a manifestation of a dismal performance of our tax administration. The government should strive for bringing more people into the tax net and restrict tax evasion through an overhaul of the country’s taxation system.

- The government has introduced changes in the taxation system to protect lower-income groups and put the burden on higher-income groups. The threshold income exempted from income tax for salaried individuals has been increased from Rs. 0.6 million to Rs. 1.2 million. Furthermore, the threshold income exempted from tax for business individuals and AOPs has been increased from Rs. 0.4 million to Rs. 0.6 million. The government has proposed a fixed tax regime for small retailers where Rs. 3,000 to Rs. 10,000 will be collected along with electricity bills. The government has proposed a capital gain tax of 15 percent on the transaction of immovable property in the first year, the advance tax rate on the purchase and sale of property for filers is proposed to be enhanced to 2 percent from the 1 percent and for non-filers, increased from 2 percent to 5 percent.

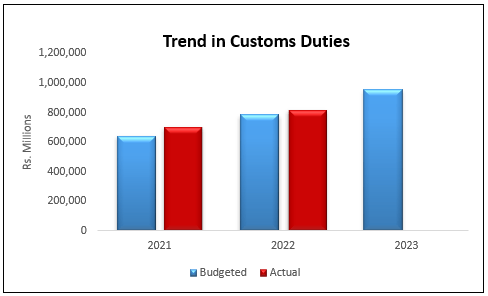

- Government’s reliance on customs duties for revenue collection continues to distort trade and manufacturing. The use of tariffs for revenue purposes affects the performance of local industries. For FY 2023, the government has anticipated a 17 percent growth in revenue collection from tariffs compared to an actual collection in the previous year. The government has rationalized 400 tariff lines related to the manufacturing sector, and extended exemptions on agricultural inputs and machinery. Although tariff rationalization is a good initiative, the country’s tariff structure is still complex. Moreover, the government continues to protect domestic industries from international competition thereby eliminating incentives for them to improve, restricting the transfer of knowledge and technology, and enforcing consumers to buy low-quality domestic products at higher prices.

- Privatization of loss making state-owned enterprises is included in the budget with expected revenue of Rs. 96 billion. Every year government includes the privatization of loss making enterprises but remains unable to carry them out. Resultantly, the government had to provide funds to bleeding enterprises to keep them afloat. The total loss of SOEs in 2019 was Rs. 143 billion. It is imperative to cut loose loss making enterprises to ease the burden on the government and put public resources to efficient use.

- External financing head in the budget brief does not indicate any inflow from IMF and China’s safe deposits. Pakistan has been struggling to fulfill the requirements to resume the IMF program for which subsidy on petroleum products and electricity was removed and prices were raised. This contradicts the previous efforts of the government to convince China to lend money to Pakistan as safe deposits and also negates the struggle to resume the IMF program. However, the government is going to borrow money from both sources. This is an effort by the government to hide external borrowing and deflate the overall debt and liabilities of the government. Therefore, the ability of the government to accurately assess the debt liabilities will be affected, which will lead to mismanagement in the debt servicing.

- Collection of Rs. 750 billion as petroleum development levy (PDL) seems difficult in the current environment of high petroleum prices. The government intended to collect Rs. 610 billion PDL in the FY 2022 but was able to collect Rs. 135 billion. Currently, a significant jump in global demand for petroleum products from ease in pandemic enforced restrictions and the start of the Russia-Ukraine War have resulted in a tremendous increase in the petroleum prices thereby making it impossible to collect intended revenues. For FY 2023, the government intends to collect a PDL of Rs. 750 billion from oil and PDL of Rs. 8 billion from gas, which will be impossible as it will contribute significantly to already unfettered inflation. The government will not be able to levy PDL as it will deteriorate the political capital of the coalition government and result in a higher than anticipated fiscal deficit.

- Government allocates Rs. 360 billion for the protection of unprivileged people under the Benazir Income Support Program. The government has increased the allocation for social protection by Rs. 114 billion to Rs. 360 billion for FY2023. This is a good initiative on behalf of the government to help the deprived segments of society who are struggling to survive when inflation remains unabated. In May 2022, food inflation cloaked at 15.5 percent in urban areas and 19 percent in rural areas. Therefore targeted support for the needy people is appreciable.

- PRIME finds the proposed budget to be lacking insight and unrealistic to achieve the sustainable growth. PRIME proposes the adoption of broad-based flat tax rates to promote compliance and voluntary registration as higher tax rates, which the current budget proposed, only contribute to higher tax evasion and avoidance. The tariff and non-tariff barriers create anti- export bias, disincentivize the industry to ameliorate, narrow their focus to domestic demand, prevent the industry to become a part of global value chains and compel citizens to pay a higher price for substandard goods. Therefore, rationalization of the entire tariff structure is inevitable for the sustainable growth of the country. The government remains incapable to cut losses by privatizing bleeding SOEs just for political aspirations but business as usual is not possible now; therefore, the government needs to set aside political motivations and ease the unnecessary financial burden. The exclusion of credit inflow from China and IMF makes the efficacy of the entire budget questionable. The dependence on higher petroleum revenues at the time of rising global prices and soaring inflation at home is also not a wise strategy for fiscal sustainability.

Download the full PDF of the budget note here: Prime Note Federal Budget 2022-23